SELF-STORAGE PREFERRED EQUITY OPPORTUNITY

NexPoint Storage Preferred

NexPoint Storage Partners, Inc. seeks to acquire or strategically develop, own, operate and when appropriate, dispose of self-storage properties in our existing or target markets.

THE OFFERING

Investment Objectives*

- MAXIMIZE CASH FLOW AND VALUE OF PROPERTIES OWNED

- ACQUIRE PROPERTIES WITH CASH FLOW GROWTH POTENTIAL

- PROVIDE QUARTERLY CASH DISTRIBUTIONS

- CREATE LONG-TERM CAPITAL APPRECIATION

Due Diligence Resources

Offering Documents and Materials

3rd Party Due Diligence Report Coming Soon

Offering Overview

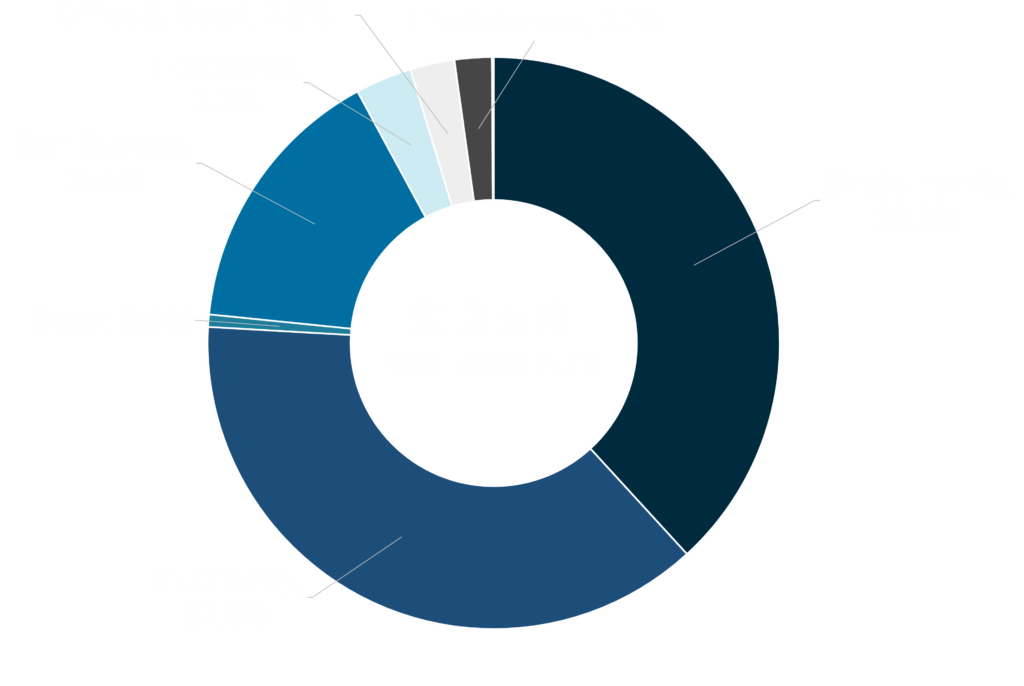

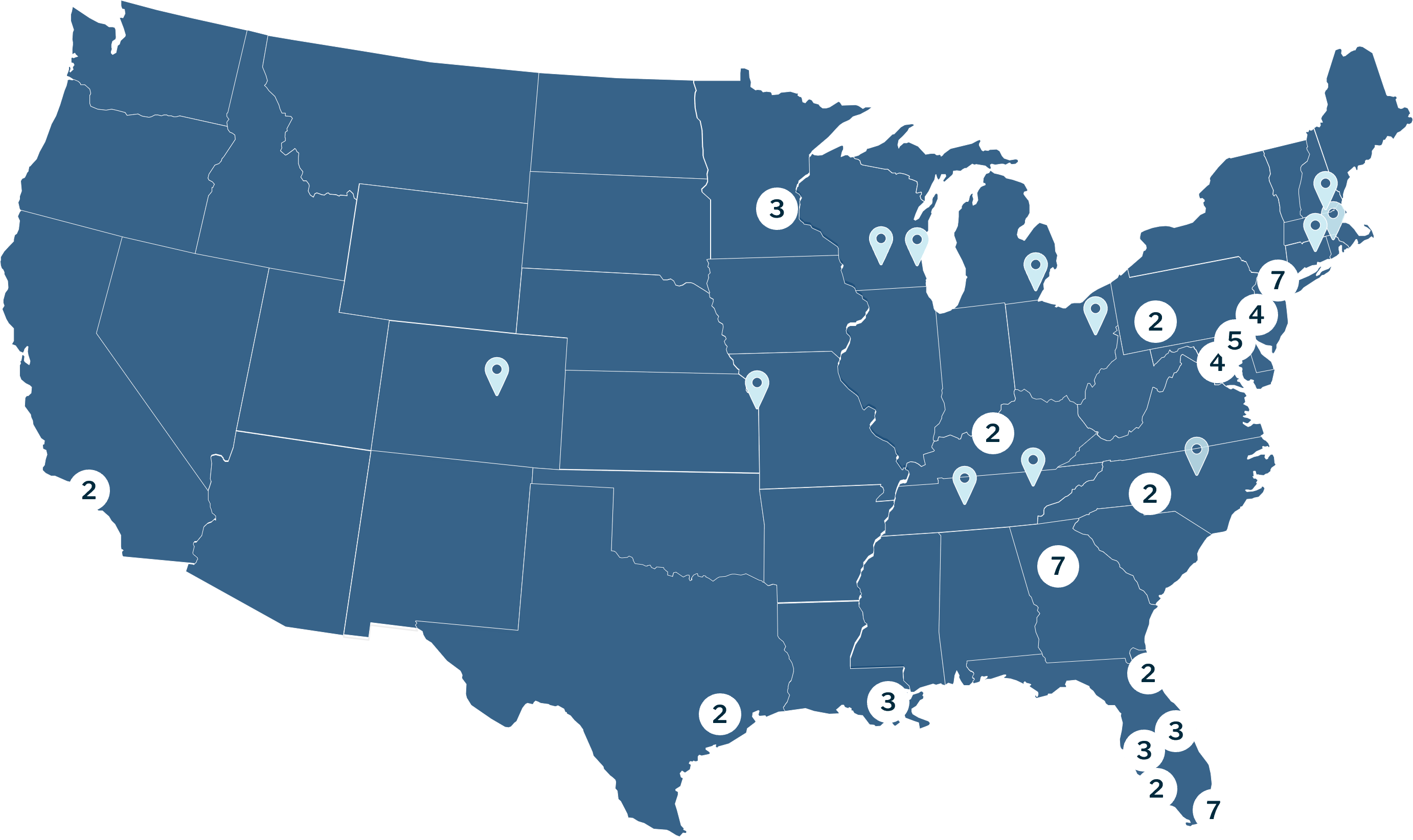

NexPoint Storage Partner's current $1.6 billion portfolio, backed by existing equity and preferred equity partners, consists of 69 GenerationV facilities predominantly located in the top 50 MSAs and targets self-storage acquisitions and development opportunities in the U.S.

Offering Overview

| Structure | Cumulative Redeemable Series E Preferred Stock Offered to Accredited Investors Only |

| Offering Price | $100 Per Share |

| Offering Size | $150,000,000 |

| Minimum Investment | $25,000 |

| Term1 | Fully Redeemable by Holder Beginning January 1, 2029, and Full Original Investment Redeemable by Holder After 2 Year Holding Period |

| Dividend Rate2 | 4% Cash Dividend Per Year (1% Per Quarter) Plus an Additional 5% Per Year Increase in Share Value. Compounded Annually |

| Term1 | Fully Redeemable by Holder Beginning January 1, 2029, and Full Original Investment Redeemable by Holder After 2 Year Holding Period |

| Reinvestment Option3 | 4% Cash Dividend May Be Reinvested in Additional Preferred Stock at a 3% Discount |

*There can be no assurance that these objectives will be realized or that a loss of capital will be avoided. | 1. 2-year hold period required before holders can redeem; Liquidity of full initial investment provided after a two-year hold period on a quarterly basis, limited to 5% of outstanding shares per quarter and a maximum of $30 million until December 31, 2028; subject to extension by up to two years if the Company exercises its right to extend the mandatory redemption date of Series D Preferred Stock; moreover, all holder requested redemptions will be suspended if the Company defaults on terms of Series D Preferred Stock. | 2. 5% annual compounding increase in the liquidation preference per Share. The Participating Liquidation Preference of a Share shall be computed at each yearly anniversary by multiplying the last share price by 1.05 and will be payable upon a holder requested redemption after December 31, 2028 or earlier redemption at the option of NexPoint Storage Partners. | 3. The Company has authorized up to $15,000,00 additional shares of preferred stock for issuance under the Dividend Reinvestment Plan at $97 per share. Distributions are cumulative, are not guaranteed and may be suspended, modified or terminated at the discretion of the Board of Directors. Distributions may be paid from offering proceeds and may include a return of capital or borrowed funds, which may lower overall returns to the investor and may not be sustainable.

Offering Highlights

Self-Storage Industry

The Fastest Growing Segment in the Last 40 Years*

*According to the Self Storage Association, a not-for-profit trade association representing the self-storage industry, the self-storage sector has been the fastest growing segment of the commercial real estate industry over the last 40 years. The demand for self-storage continues to strengthen as healthy job growth, rising wages and the formation of new households support the need for self-storage.

Latest Generation of Facilities

The self-storage facilities comprising NexPoint Storage Partners are the latest generation (average age of approximately three years) and of the highest quality in the self-storage industry (new, multi-story, secure, climate-controlled). Such facilities are referred to as GenV Storage Facilities. NexPoint Storage's properties are favorably located (within the urban core, in high-density areas with strong demand drivers).

Strength of Markets

NexPoint Storage's properties are located predominately (over 90%) in top 50 U.S. MSAs, with almost 75% being in top 25 MSAs. Larger MSAs typically produce higher occupancies and rental rates for self-storage facilities.

Experienced Property Management

Each of the Properties is managed by Extra Space Management, Inc., an affiliate of Extra Space Storage, Inc. (NYSE: EXR). Extra Space is a leading third-party manager and the second-largest operator of self-storage properties in the United States. Extra Space utilizes the industry- leading revenue management systems, dynamic online marketing programs, and possesses 40 years of self-storage experience.

LOCATED IN DENSE

URBAN MARKETS

PREDOMINANTLY

CLIMATE

CONTROLLED

MULTI-STORY BUILDINGS

CLASS A

PROPERTIES

NEWLY

BUILT OR RENOVATED

TECHNOLOGICALLY

ADAPTED

STRONG POPULATION

GROWTH IN MARKET

HIGH DENSITY OF

MULTIFAMILY RENTERS

ABOVE -AVERAGE

HOUSEHOLD INCOMES

GenerationV Facilities

NexPoint believes that GenV Storage Facilities in the top 50 United States MSAs have the potential to perform better over time than facilities in smaller markets and older generation facilities, wherever located.

The Self-Storage Sector

Best Performing Asset Class Over the Last 25 Years

Self-Storage has Shown Resiliency in Economic Downturns

Institutional Self-Storage has been the best-performing asset class for 25 years

–13.85% annual price and 18.83% total annual return is >300bps higher than the next leading sector (NAREIT)1

39.5

92

14

79.43

1 NAREIT 2Self-Storage Association 3Storage Demand Statistics, Neighbor: https://www.neighbor.com/storage-blog/self-storage-industry-statistics/, updated May 6, 2022. 4 REIT.com

The Self-Storage Sector

An Asset Class with Strong Demand

Historical demand drivers for self-storage include traditional life events that always exist, such as relocation/temporary dislocation (college students, natural disasters), in-town moves, renovation, and death/divorce/downsizing. The presence of these life realities make self-storage a necessity rather than a luxury.

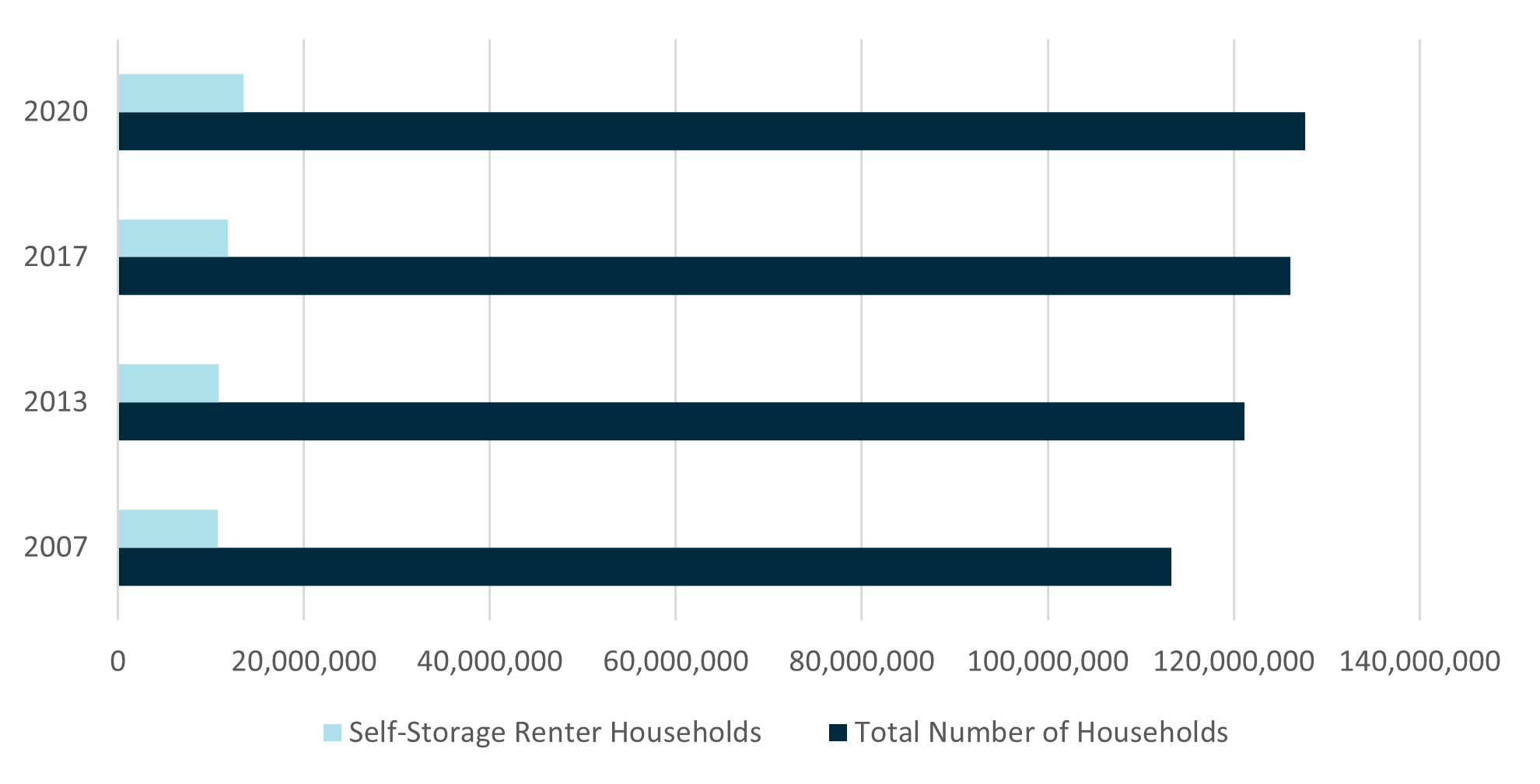

Total Number of Households that Have a Storage Unit5

Since 2005, 3.5 million more households rent self-storage units for a total of 13.5 million self-storage renting households, an all time high, 10.6% of total households.

COVID-19 Produced New Demand Drivers

Six in ten U.S. workers who can work from home choose to do so all or most of the time, increasing the percentage of remote workers from 23% to 59% since the pandemic.6

5Self-Storage Association: Demand Study, 2020 Edition 6Pew Research Center, COVID-19 Pandemic Continues to Reshape Work in America (Pub. Feb. 2022)

NexPoint Storage Partners is a self-storage real estate investment group created through NexPoint’s 2020 take-private transaction with Jernigan Capital, Inc. (“JCAP”), which was an NYSE-listed REIT. NexPoint Storage Partners builds on the original mission of JCAP to invest in newly built, multi-story, climate-controlled, Class-A self-storage facilities known as GenV storage facilities located in dense and growing markets throughout the United States.

A History of Portfolio Growth

01#

NEWEST PORTFOLIO

Newly built or renovated GenV storage facilities with an average age of approximately three years

02#

STRATEGICALLY SELECTED

Target facilities located in the top 50 MSAs that have higher population growth rates, greater population densities and above-average household income

03#

BUILT-IN GROWTH

The portfolio has built-in growth potential through additional stabilization (occupancy and rental rates) of the properties and additional acquisition opportunities, including the absolute right to reacquire 20 DST self-storage properties, having a current value of ~$650 million

The NexPoint Storage Partners’ broader portfolio was developed from the ground up with entrepreneurial developers having substantial experience in selecting, acquiring and entitling sites for self-storage development. 91% of our facilities are located within the top 50 U.S. MSAs and 73% are located within the top 25 U.S. MSAs.

Since early 2015, NSP (and JCAP) has underwritten over $13 billion of prospective self-storage investments and developed a high quality portfolio of GenV Storage Facilities. The self-storage platform has grown from a blind pool of $110 million of initial capital on April 1, 2015, to an investment portfolio valued today at approximately $1.6 billion.

Submarkets Positioned for Success

Target Market Criteria

NEXPOINT, JCAP & SAFSTOR

NexPoint’s $125 million commitment to and investment in Jernigan Capital was widely publicized due to JCAP’s then-status as an NYSE-listed company.

Utilizing a deep understanding of the asset class and expertise developed in evaluating JCAP in the due diligence process, NexPoint was able to provide funds to SAFStor, a leading developer and owner of institutional-quality self-storage facilities.

NexPoint capitalized on this opportunity, developing a portfolio of GenV self-storage facilities with SAFStor.

Extra Space is committed to being the most convenient, secure and professional storage solution in neighborhoods.

Extra Space is a leading 3rd party self-storage management platform for a reason.

The size and scale of Extra Space Management, Inc., our Property Manager, give it increased data, operating leverage, cost efficiencies, and better decision-making abilities. It is able to leverage its industry-leading operating platform and performance to the ultimate benefit of its partners’ properties. At the same time, it is not so big that it can’t work locally with the 2,300+ properties it manages in 41 states plus the District of Columbia.

2,300+

Properties

41

States

All NexPoint Storage properties are managed by Extra Space Management, Inc., an affiliate of Extra Space Storage, Inc., a self-administered and self-managed REIT and a member of the S&P 500, headquartered in Salt Lake City, Utah.

Extra Space Storage, Inc.’s properties comprise approximately 1.6 million units and over 176.0 million square feet of rentable storage space. It offers customers a wide selection of conveniently located and secure storage units across the country, including boat storage, RV storage and business storage.

Professional Managers

Over 2,300 Convenient Locations

State-of-the-Art Security

Clean and Well-Lit

Variety of Sizes

Climate-Controlled Units

EXPERTS IN REAL ESTATE1

NexPoint Real Estate Track Record

1Real estate assets as of 3/31/2023, inclusive of affiliates.

2Real estate assets acquired from January 1, 2012 to March 31,2023, inclusive of affiliates.

Please reference the NexPoint Track Record included in this material, or visit https://nexpoint.wpenginepowered.com/wp-content/uploads/2021/11/NREA-Track-Record-Piece.pdf

EXPERTS IN REAL ESTATE

NexPoint Storage Partners Management Team

John Good

Chief Executive Officer

John Good is the CEO and a member of the board of directors of NexPoint Storage Partners. Good lends his many years of real estate, legal, investment, and capital markets experience to the broader NexPoint platform in a senior advisory capacity. Good has been in the REIT and financial services industries for nearly three decades. Prior to joining NexPoint, Good was Chairman and CEO of Jernigan Capital, Inc., a NYSE-listed self-storage REIT.

Brian Mitts

Chief Financial Officer, Secretary, and Treasurer

Brian Mitts is the CFO and a member of the board of directors of NexPoint Storage Partners and serves numerous roles across the NexPoint platform. Currently, Mitts leads NexPoint’s financial reporting and accounting teams and is integral in financing and capital allocation decisions. Mitts was also a cofounder of NREA, as well as NXRT and NexPoint Advisors, L.P., the parent of NREA. He has worked for NREA or one of its affiliates since 2007.

Matthew McGraner

President

Matt McGraner is the CIO and a member of the board of directors of NexPoint Storage Partners and serves numerous roles across the NexPoint platform. With over ten years of real estate, private equity and legal experience, his primary responsibilities are to lead the strategic direction and operations of the real estate platform at NexPoint. acquisitions. McGraner has led the acquisition and financing of approximately $18.4 billion of real estate investments.

Disclosures & Risks

This document does not constitute an offer to sell or a solicitation of an offer to buy any securities. Any securities will be offered only by means of a Confidential Private Placement Memorandum (“Memorandum”) provided to a limited number of accredited investors.

This document has been prepared by NexPoint Storage Partners (“NexPoint Storage ”, the “Company”, or “We”) to provide preliminary information about the offering (“the Offering”) of shares of the Company’s Cumulative Redeemable Series E Preferred Stock (the “Shares”). Some of the information contained in this document is non-public, confidential and proprietary in nature and may constitute trade secrets under applicable law with respect to the Offering, NexPoint Storage and the investments made by NexPoint Storage and its affiliates, the disclosure of which could have material adverse effects on the Offering, the Company or the Company’s respective investments and affiliates.

Investing in the Company involves a number of significant risks and other important factors relating to investments in real estate generally, and relating to the strategy and investment objectives of the Company in particular.

Prospective investors should carefully consider the following risk factors, together with all of the other information (including risk factors) included in the Memorandum before deciding to purchase Shares. As a result of these factors, as well as other risks inherent in any investment, there can be no assurance that the Company will be able to meet its investment objectives or otherwise be able to successfully to carry out its investment program.

An investment in the Company is not a direct investment in real estate, but rather an investment in a REIT that owns self-storage assets.

GENERAL REAL ESTATE RISKS. The Company will be subject to the risks incident to the ownership and operation of real estate, including risks associated with the general economic climate, local real estate conditions (including the availability of excess supply of properties relative to demand), changes in the availability of debt financing, credit risk arising from the financial condition of tenants, buyers, and sellers of properties, geographic or market concentration, competition from other spaces, government regulations, fluctuations in interest rates and various other risks. The Company or its subsidiary entities will incur the burdens of ownership of real property, which include paying expenses and taxes, maintaining the investments, and ultimately disposing of the Portfolio. LIMITED LIQUIDITY AND TRANSFERABILITY OF SHARES. There is no public market for the Shares and no such market is expected to develop in the future. The Company is not required to redeem the Shares at any time, and the ability of the Company to complete redemptions requested by holders is limited by restrictions on redemption in the terms of the Company’s Series D Preferred Stock and the consent of Extra Space to holder redemptions. Consequently, the purchase of Shares should be considered only as a long term and illiquid investment and Shares should only be acquired by investors who are able to commit their funds for an indefinite period of time. FACTORS IMPACTING THE SELF-STORAGE MARKET. Our investment strategy is premised on assumptions about occupancy levels, rental rates, interest rates, supply and demand, acquisition and operating costs and other factors in the self-storage market. If those assumptions prove to be inaccurate, our cash flows and profitability will be reduced. An increase in supply, economic recession or other tightening demand would reduce our rental revenue and profitability. LEVERAGE. The Company may continue to utilize leverage or enter into hedging agreements related to its debt in connection with its respective investments. Significant borrowings increase the risks of an investment in the Company. If there is a shortfall between the cash flow from investments and the cash flow needed to service the Company’s indebtedness, then the amount available for distributions to stockholders may be reduced. In addition, incurring mortgage debt increases the risk of loss because defaults on indebtedness secured by a property may result in lenders initiating foreclosure actions. SENIOR SECURITIES. The Company has two classes of preferred stock outstanding that rank senior to the Shares – Series C Preferred Stock and Series D Preferred Stock. Such preferred stock has preferential rights to distributions and in the event of liquidation and have certain consent rights that limit our ability to take certain actions, including redemptions of the Shares. POTENTIAL CONFLICTS OF INTEREST. Certain employees of NexPoint will have conflicts of interest in allocating their time between the Company and their other business activities. Additionally, affiliates of NexPoint own and operate and may continue to own and operate, in the future, other properties outside the Portfolio, which may result in a conflict of allocation of services and costs.

We may pay distributions from sources other than our cash flow from operations, including, without limitation, the sale of assets, borrowings or offering proceeds (including from sales from our common stock or common units of membership units (“OC Units”) to affiliates of NexPoint), and we have no limits on the amounts we may pay from such sources. Funding distributions from such sources will result in us having less funds available to acquire self-storage properties or other real estate related investments.

As a result, the return you realize on your investment may be reduced. To the extent we borrow funds to pay distributions, we would incur borrowing costs and these borrowings would require a future repayment. The use of these sources for distributions and the ultimate repayment of any liabilities incurred could adversely impact our ability to pay distributions in future periods and decrease the amount of cash we have available for operations and new investments. NexPoint Real Estate Advisors, L.P. (“NREA”) is the sole sponsor of the Offering. NREA is wholly owned by NexPoint Advisors, L.P. (“NexPoint”). Past performance does not guarantee future results. Performance during time periods shown is limited and may not reflect the performance in difference economic and market cycles. There can be no assurance that similar performance will be experienced. Investing in the Company involves a number of significant risks and other important factors relating to investments in companies generally, and relating to the strategy and investment objectives of the Company in particular. Prospective investors should carefully consider the foregoing risk factors, together with all of the other risk factors and information included in the Memorandum, before deciding to purchase shares. As a result of these factors and the risk factors in the Memorandum, as well as other risks inherent in any investment, there can be no assurance that the Company will be able to meet its investment objectives or otherwise be able to successfully to carry out its investment program.

NexPoint Securities, Inc., member FINRA/SIPC, is the dealer manager for the NexPoint Storage Partners, Inc. offering.