NexPoint Storage IV DST

This Offering includes three strategically developed self-storage properties with high occupancy rates in two high-growth MSAs.

Due Diligence Resources

Offering Documents and Materials

The NexPoint Storage IV DST properties are all located in the Phoenix, Arizona and St. Pete, Florida MSAs.

Acquisition Details

| Total Acquisition Cost2 | $63,766,932 |

| Supplemental Reserves | None |

| Lender Reserves** | None |

| Total Capitalization | $70,344,106 |

Highlights of the Trust

| Offering Size | $70,344,106 |

| Minimum Purchase -Cash | $100,000 |

| Minimum Purchase -1031 | $100,000 |

| Loan-to-Value | 0% |

| Suitability | Accredited Investor Only |

1. The Properties in this Offering are: (i) the Ahwatukee Asset(which consists of the storage facility, but not the land on which the facility is constructed), (ii) the Cave Creek Asset (which consists of the storage facility, but not the land on which the facility is constructed), and (iii) the 7th Asset (which consists of the storage facility and the land upon which the facility is constructed).

2. The Total Acquisition Cost includes the purchase price of the Properties and Other Closing Costs.

There are substantial risks in any investment program. See “Risk Factors” on page 21 of the PPM for a discussion of the risk relevant to the Offering.

Please review the entire PPM prior to investing. Reference is made to the PPM for a statement of risks and terms of the Offering. The information set forth herein is qualified in its entirety by the PPM.

All potential Purchasers must read the PPM and no person may invest without acknowledging the receipt and complete review of the PPM.

SELF-STORAGE INDUSTRY

The Fastest Growing Segment in the Last 40 Years1

1According to the Self Storage Association, a not-for-profit trade association representing the self-storage industry, the self-storage sector has been the fastest growing segment of the commercial real estate industry over the last 40 years. 1 The demand for self-storage continues to strengthen as healthy job growth, rising wages and the formation of new households support the need for self-storage.

Latest Generation of Facilities

The Properties offered in the portfolio are multi-story, secure, predominantly climate controlled. The Properties are the latest generation facilities (built or renovated within the last five years). The Properties are within the urban core, in high density areas with strong demand drivers. Such facilities are referred to as GenV Storage Facilities.

Strength of Markets

The Properties are located in two major United States MSAs (Phoenix MSA, and St. Pete MSA) exhibiting, in aggregate, above-average population and job growth over the past five years, are near large cities and contain many of the demand drivers that can produce high occupancies and rental rates for self-storage facilities.

Experienced Property Management

Each of the Properties is managed by Extra Space Management, Inc., an affiliate of Extra Space Storage, Inc. (NYSE: EXR), a leading owner and operator of self-storage properties utilizing latest generation revenue management systems, experienced data scientists, leading digital marketing techniques, and possessing many years of self-storage experience.

What is a GenV Storage Facility?

NexPoint believes that GenV Storage Facilities in the top 50 United States MSAs have the potential to perform better over time and create more value than facilities in smaller markets and older generation facilities, wherever located.

LOCATED IN DENSE

URBAN MARKETS

CLASS A

PROPERTIES

PREDOMINANTLY

CLIMATE

CONTROLLED

NEWLY

BUILT OR RENOVATED

TECHNOLOGICALLY

ADAPTED

STRONG POPULATION

GROWTH IN MARKET

MARKET OVERVIEW

Phoenix, Arizona MSA

‘The Valley of the Sun1‘

The Phoenix MSA is often referred to as the Valley of the Sun and consists of Maricopa and Pinal counties.

RAPID EMPLOYMENT GROWTH1

Job gains will increase faster than the national rate during the next five years, drawing new residents to the metro.

HIGH TECH MANUFACTURING BASE1

Intel Corp., General Dynamics, Honeywell and others have large Phoenix operations, attracting others serving these corporations

4.9M Population2

At a population just shy of 5m, the Phoenix MSA now boasts ~340 residents per square mile

$75K Income2

The median household income in the Phoenix MSA is about 10% higher than the rest of the United States.

2.0M Housing Units2

The Phoenix MSA contains over 2M units, with 92% occupancy and 67% owner occupancy.

3X Sales Growth3

Self-Storage leases in Phoenix were over $180M in 2021, almost tripling the $63 M from 2020.

1Marcus & Millicha, Phoenix Self-Storage Opportunity, 2022 via https://www.marcusmillichap.com/services/property-types/self-storage.

2 U.S. Census Bureau, 2022. 3. Phoenix Business Journal, 2022

Moody’s Analytics, May 2021.; Florida Dept. of Economic Opportunity, , Best Places, Forbes,, GFL Alliance

PHOENIX MSA

Phoenix, Arizona

Ahwatukee Asset1

15785 South Desert Foothills Parkway, Phoenix (Ahwatukee), AZ 85048

Ahwatukee Asset features two stand-alone climate-controlled buildings with two levels above grade and one below featuring a connecting basement with units. It boasts extended-hour access with 24-hour video surveillance throughout, premium lighting, secure keypad entry, a large leasing office with prominent signage and high-end elevators.

713

Units

77,670

SQFT

85.0%

Occupancy

Built in

2020

Property Highlights

Accelerated Lease Up

With 4.54% average monthly occupancy gain; it achieved stabilized occupancy in less than 20 months of operation.

High Quality

Ahwatukee boasts premium class “A” multi-story construction and amenities demanding high rates in the submarket.

High Barrier to Entry Submarket

Ahwutakee has a supply/demand ratio of just 3.97 square feet per capita and is the only class “A” facility in the three-mile trade area.

1. Marcus & Millicha, Phoenix Self-Storage Opportunity, 2022 via https://www.marcusmillichap.com/services/property-types/self-storage

2. The Ahwatukee Asset consists of the storage facility, but not the land on which the facility is constructed.

Cave Creek Asset1

16045 N Cave Creek Rd.

Phoenix, AZ 85032

Since opening in July of 2020, Cave Creek Asset has exceeded leasing projections averaging over 3.4% per month gain. Cave Creek resides in a dense residential trade area located in a heavily traveled thoroughfare with major retailers such as Home Depot less than a mile from the facility.

763

Units

77,175

SQFT

78.4%

Occupancy

Built in

2020

Property Highlights

Building Layout

The Cave Creek Asset boasts a contiguous multi-story 77,175 net rentable square feet (NRSF) climate-controlled building with 763 interior units. It features an insulated roof and metal framed construction with painted stucco exteriors, brick accents, and a glass storefront. Cave Creek is accessible via a centralized interior pull -through elevators loading area with convenient access to two.

Amenities & Features

The property features a wide drive-through air conditioned loading area, prominent back lit monument signage at the ground level, elevated signage on the exterior of the building, well appointed large institutional leasing office, digital keypad security access at all ingress points and has a sprinkler system throughout.

Positive Leasing Momentum

Since opening in July of 2020, the property has exceeded leasing projections averaging over 3.4% per month gain.

High Quality

The Cave Creek Asset boasts premium class “A” multi-story construction and amenities demanding high rates in the submarket.

Desirable Location

The Cave Creek Asset is a dense residential infill trade area located on a heavily traveled thoroughfare, with major retailers such as Home Depot less than a mile from the facility.

1. The Cave Creek Asset consists of the storage facility, but not the land on which the facility is constructed

2. Marcus & Millicha, Phoenix Self-Storage Opportunity, 2022 via https://www.marcusmillichap.com/services/property-types/self-storage

MARKET OVERVIEW

St. Pete MSA

The St. Pete MSA contains the third and fourth largest cities in the state of Florida, Tampa and St. Petersburg. Its growing consumer market and desirable proximity to both South Florida and markets to the north mark the St. Pete MSA as one of the more dynamic areas of the country. Many leading logistics and business services firms are located in the MSA and tourism continues to play an increasingly important role.

Business Expansion

Companies are migrating to the St. Pete MSA, largely due to economic factors such as no personal income tax, low cost of living, and a diverse population. Business migration is projected to double the national average in 5 years¹.

Labor Force Increase

The state of Florida’s labor force has increased for 11 consecutive months, now with over 50,000 workers and a growth rate of 5.4% over the year¹.

Population Growth

With over 3.0 Million people, the St. Pete MSA is the third-largest MSA in the Southeast¹. It has seen a 13.8% population increase since 2011¹.

Millennial Migration

Millennials have begun their migration to the St. Pete MSA, in part due to white- collar jobs covering 64.4% of the market, cost of living, and local airports providing non-stop service to 90 destinations¹.

1 Cushman Wakefield. St. Pete Self-Storage Opportunity via cushwakeselfstorage.com

Moody’s Analytics, May 2021.; Florida Dept. of Economic Opportunity, , Best Places, Forbes,, GFL Alliance

St. Pete MSA

7th Asset1

St. Pete 7th Asset: 1650 7th Ave. N, St. Petersburg, FL 33713

7th Asset2

1650 7th Ave. N

St. Petersburg, FL 33713

The 7th Asset offers a wide selection of storage units and convenient amenities like climate-controlled storage, vehicle storage, and security. It features unit sizes as small as 4×5 and as large as 10×30 and unit features like first-floor access and elevator access.

856

Units

88,811

SQFT

90.0%

Occupancy

About the Property

Amenities & Features

The property offers 24/7 access, sturdy moving carts for heavy items, elevators for easy access to upper levels, accommodations for large trucks, wide-drive aisles, on-site office, and compliant with ADA requirements.

Convenience

Located near the corner of 7th Ave N and 16th St N off I-275, Extra Space Storage serves St. Petersburg residents near Historic Uptown, Historic Kenwood, The Edge District, Downtown St. Petersburg, and more. Locals will recognize our facility three blocks west of St Anthony’s Hospital.

Building Layout

With 88,811 total NRSF. the property features a multi-story climate-controlled building with 856 total units. The building offers tenant access, as well as a leasing office, open to the public 5 days a week, for around 8 hours a day. Convenient access to the building is available from elevator or stair access.

Security

The property is equipped with security measures like video surveillance and electronic gate access to provide a safe environment for customers and their belongings.

1. Cushman Wakefield. St. Pete Self-Storage Opportunity via cushwakeselfstorage.com

2. The 7th Asset consists of the storage facility and the land upon which the facility is constructed.

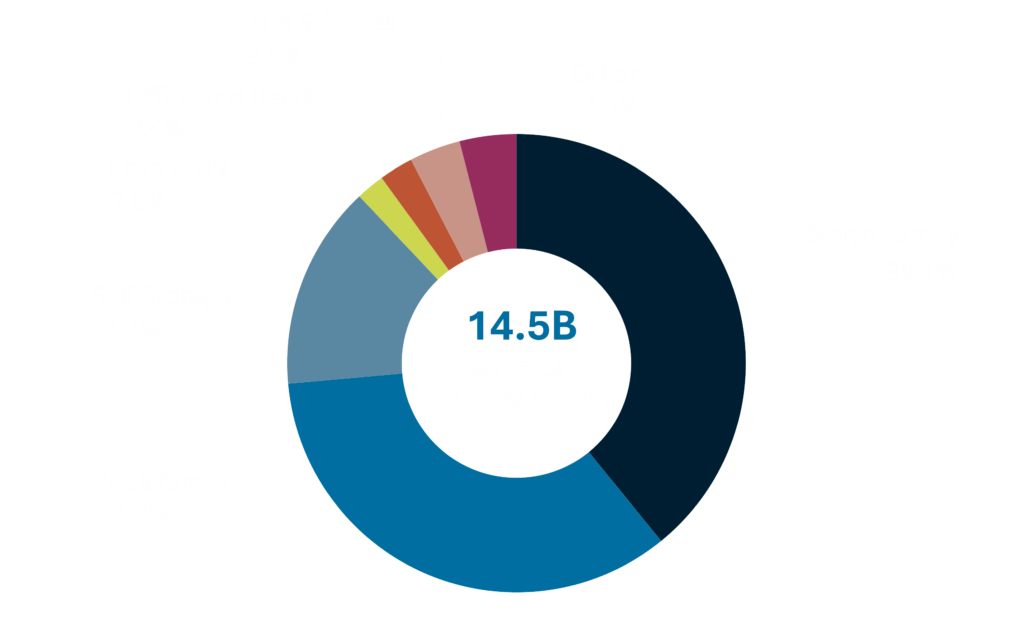

Experts in Real Estate

Real Estate Track Record1

1. Real estate assets as of 09/30/2024, inclusive of affiliates. 2. Real estate assets acquired from January 1, 2012 to September 30, 2024, inclusive of affiliates.

EXPERTS IN REAL ESTATE

NexPoint Storage Partners Management Team

John Good

Chief Executive Officeer

John Good is the CEO and a member of the board of directors of NexPoint Storage Partners. Mr. Good lends his many years of real estate, legal, investment, and capital markets experience to the broader NexPoint platform in a senior advisory capacity. Mr. Good has been in the REIT and financial services industries for nearly three decades. Prior to joining NexPoint, Mr. Good was Chairman and CEO of Jernigan Capital, Inc., a NYSE-listed self-storage REIT.

Matthew McGraner

President

Matthew McGraner is a member of the investment committee for the Sponsor and serves numerous roles across the NexPoint platform. With over ten years of real estate, private equity and legal experience, his primary responsibilities are to lead the strategic direction and operations of the real estate platform at NexPoint. acquisitions. Mr. McGraner has led the acquisition and financing of approximately $18.4 billion of real estate investments.

Brian Mitts

Chief Financial Officer | Secretary and Treasurer

Brian Mitts is a member of the investment committee for the Sponsor and serves numerous roles across the NexPoint platform. Currently, Mr. Mitts leads NexPoint’s financial reporting and accounting teams and is integral in financing and capital allocation decisions. Mr. Mitts was also a cofounder of NREA, as well as NXRT and NexPoint Advisors, L.P., the parent of NREA. He has worked for NREA or one of its affiliates since 2007.

Extra Space is committed to being the most convenient, secure and professional storage solution in neighborhoods.

Extra Space is One of the Largest 3rd party Self-Storage Management Platform for a Reason1.

The Property Manager’s (i.e. Extra Space Management, Inc.) size and scale give it increased data, better decision-making abilities, and more efficient cost structures. It is able to leverage its scale and make informed decisions that ultimately benefit its partners’ properties.

1800+

Properties

40

States

All Properties in the Offering are managed by Extra Space Management, Inc., an affiliate of a self-administered and self-managed REIT and a member of the S&P 500, headquartered in Salt Lake City, Utah.

Extra Space Storage, Inc.’s properties comprise approximately 1.4 million and over 152.6 million square feet of rentable storage space. It offers customers a wide selection of conveniently located and secure storage units across the country, including boat storage, RV storage and business storage.

1. Inside Self-Storage, Top Operators List 2022 via https://www.insideselfstorage.com/iss-top-operators-facility-owners

Professional Managers

Over 1,800 Convenient Locations

State-of-the-Art Security

Clean and Well-Lit

Variety of Sizes

Climate-Controlled Units

NexPoint Storage Partners is a self-storage real estate investment group created through NexPoint’s take-private acquisition of Jernigan Capital Inc. (“JCAP”). NexPoint Storage Partners builds on the original mission of JCAP to invest in newly built, multi-story, climate-controlled, Class-A self-storage facilities known as GenV Storage Facilities located in dense and growing markets throughout the United States.

Class A, Newly Built or Renovated GenV Storage Facilities

Strategically Selected Submarkets

25+

Years of Self-Storage Growth and Development

NexPoint Storage Partners: A History of Portfolio Growth

The NexPoint Storage Partners’ broader portfolio was developed from the ground up with entrepreneurial developers having substantial experience in selecting, acquiring, and entitling sites for self-storage development. 96% of our facilities are located within the top 75 U.S. MSAs and 82% are located within the top 25 U.S. MSAs.

Since early 2015, NSP (formerly JCAP) has underwritten over $12 billion of prospective self-storage investments and developed a high-quality portfolio of GenV Storage Facilities. The self-storage platform has grown from a blind pool of $110 million of initial capital on April 1, 2015, to an investment portfolio valued today at greater than $1.7 billion.

Disclosures & Risks

An investment in NexPoint Storage IV DST is highly speculative, illiquid and involves substantial risk including the potential loss of your entire investment.

The photos presented in this brochure are of the actual Properties that are part of the Offering.

There are substantial risks in any investment program. See “Risk Factors” on page 21 of the accompanying PPM for a discussion of the risks relevant to this Offering. Distributions are not guaranteed. The forecasted distribution rates are only estimates based on the specific assumptions more fully described in the PPM. There is no guarantee that the assumptions used in the projections will be actualized. Please review the entire PPM prior to investing. Reference is made to the PPM for a statement of risks and terms of the Offering. The information set forth herein is qualified in its entirety by the PPM. All potential investors must read the PPM and no person may invest without acknowledging receipt and complete review of the PPM.

An investment in an Interest is highly speculative and involves substantial risks including, but not limited to:

- this is a “best-efforts” offering with no minimum raise or minimum escrow requirements;

- the lack of liquidity and/or public market of the Interests;

- the holding of a beneficial interest in the Parent Trust with no voting rights with respect to the management or operations of the Trusts or in connection with the sale of the Properties;

- The 7th property is located in a “Hurricane Susceptible Region,” which increases the risk of damage with owning, financing, operating and leasing self-storage facilities, and real estate generally, in Florida;

- The Ahwatukee Improvements and the Cave Creek Improvements are located at a part of the country that has a higher risk of exposures to wild fires;

- risks associated with the self-storage industry, such as occupancy and rate fluctuations and relatively low capital requirements or other barriers to entry for competing properties;

- risks associated with the impact of pandemics, including the COVID-19 pandemic, on the Properties and the economics of the communities in which the Properties exist;

- the Trusts depend on the Master Tenants for revenue, and the Master Tenants depend on the Tenants for revenue and thus any default by the Master Tenants or the Tenants will adversely affect the Trusts’ operations;

- performance of the Master Tenants under their respective Master Leases, including the potential for the Master Tenants to defer a portion of rent payable under such Master Leases;

- reliance on the Master Tenants and the Property Manager engaged by the Master Tenants, to manage each of the Properties

- risks associated with the Sponsor funding the Demand Notes that capitalize each of the Master Tenants;

- the existence of various conflicts of interest among the Sponsor, the Trusts, the Master Tenants, the Asset Manager, the Property Manager, and their affiliates;

- material tax risks, including property identification risks and treatment of the Interests for purposes of Code Section 1031, the treatment of the Sale-Leasebacks and Land Subleases for federal income tax purposes, and the use of exchange funds to pay acquisition costs, which may result in taxable boot;

- the Interests not being registered with the Securities and Exchange Commission (the “SEC”) or any state securities commissions;

- the lack of a public market for the Interests;

- risks relating to the impact of the Ground Lease default, given that a default under one of the Ground Leases is a default under the other Ground Lease;

- risks relating to the renewal of the Land Subleases and the right to use the Ahwatukee Land and Cave Creek Land on which the Ahwatukee Improvements and Cave Creek Improvements are located following the expiration of the Land Subleases;

- risks relating to the costs of compliance with laws, rules and regulations applicable to the Properties;

- risks related to competition from properties similar to and near the Properties; and

- the possibility of environmental risks related to the Properties.

NexPoint Securities, Inc., an entity under common control with the Sponsor, serves as the Managing Broker-Dealer of the offering. The Managing Broker-Dealer was formed in November 2013 and is registered as a broker-dealer with the Securities and Exchange Commission and is a member of FINRA/SIPC.

PLEASE CONTACT YOUR ADVISOR WITH ANY QUESTIONS ABOUT THIS OFFERING.