NexPoint Semiconductor Manufacturing DST features a single industrial manufacturing property located in Temecula, California. The Offering features a triple net lease, a brand new 15-year lease with built-in 3% rent bumps every year, and the tenant delivers highly integrated products featuring a proprietary and uniquely sized wafer that allows for more efficient chip production.

Quick Links

3rd Party Due Diligence Report

Coming Soon

Sign Selling Agreement via DocuSign

Request a Link to Sign Below

Offering Snapshot

This Offering features a single industrial manufacturing property located in Temecula, California. NexPoint believes that the Property presents an attractive long-term investment opportunity due to strong industry tailwinds, high-quality construction and infrastructure, strong Tenant (i.e. Skorpios Technologies Inc.), use fundamental to the Tenant’s business, desirable triple net lease terms (including the 15-year initial duration of the Tenant Lease with extension options), and a strategic location. The semiconductor manufacturing industry is a high-growth space, with substantial real estate supply-demand tailwinds.

Acquisition Details

Total Acquisition Cost1

$195,890,310

Lender Reserves2

$3,250,000

Total Capitalization

$211,944,633

Highlights of the Trust

Offering Size

$136,944,633

Minimum Purchase – Cash

$100,000

Minimum Purchase – 1031

$100,000

Suitability

Accredited Investors Only

Loan Information

Total Loan Amount

$75,000,000

Loan-To-Capitalization

35.39%

Interest Rate

6.635% Fixed Rate

Amortization

Interest Only for Full Term

Loan Term

10 Years

1The Total Acquisition Cost includes the purchase price of the Property, the Facilitation Fee, the Loan Costs, and Other Closing Costs. 2 Lender Reserves refers to the Rollover Reserve, the Replacement Reserve, and the Rent Concession Reserve. 3. The loan-to-capitalization ratio (“LTC”) is the ratio of a loan to the capitalization of an asset purchased. For instance, if someone borrows $80,000 to purchase a property worth $100,000, the LTC ratio is $80,000 to 100,000 or $80,000/100,00, or 80%.

There are substantial risks in any investment program. See “Risk Factors” on page 16 of the PPM for a discussion of the risks relevant to the Offering.

Please review the entire PPM prior to investing. This material does not constitute an offer to sell. Reference is made to the PPM for a statement of risks and terms of the Offering. The information set forth herein is qualified in its entirety by the PPM. All potential Purchasers must read the PPM and no person may invest without acknowledging the receipt and complete review of the PPM.

Semiconductor Manufacturing

Semiconductors are at the Core of America’s Economy

Central Processor for Emerging Tech like Artificial Intelligence

Semiconductors serve as the central processing units of contemporary electronics, driving advancements in various fields such as medical devices, healthcare, telecommunications, computing, defense, transportation, clean energy, and emerging

technologies like artificial intelligence, quantum computing, and advanced wireless networks.

More Computing Power in Your Hand than the Moon Landing

Through rapid innovation, the semiconductor industry continually produces significantly more advanced products at reduced costs. A modern smartphone now has a greater computing system than the computers used by NASA for the 1969 moon landing.

U.S. Leads Global Manufacturing for Semiconductors1

The United States leads the global semiconductor industry, boasting roughly half of the worldwide market share and achieving sales totaling $258 billion in 2021.

Key Workforce Catalyst1

This industry directly provides employment to over a quarter of a million individuals in the United States, additionally supporting nearly 1.8 million related jobs.

Semiconductors Rank in Top 5 U.S. Exports1

Semiconductors rank as one of the top five exports for the United States, with over 80% of U.S. semiconductor firms’ sales originating from international customers. In 2021, the U.S. exported $60 billion worth of semiconductors and maintained a consistent trade surplus in this sector.

Primary Driver of Labor Productivity

The U.S. semiconductor industry stands as the primary driver of labor productivity growth in America. Semiconductor technology has significantly enhanced the efficiency and effectiveness of virtually all sectors of the U.S. economy, from agriculture to manufacturing.

$50 Billion in Research Funding1

Annually, the U.S. semiconductor industry dedicates roughly one-fifth of its revenue, equivalent to $50 billion in 2021, to research and development.

18 States Dominate the Market1

Approximately 50% of semiconductor manufacturing for U.S. companies occurs within the United States, with significant manufacturing facilities located in 18 different states.

1Semiconductor Industry Association: 2022 State of the U.S. Semiconductor Industry

SEMICONDUCTOR GOVERNMENT INCENTIVES

2022 Chips and Science Act

Passed on August 9, 2022, the Chips and Science Act provides semiconductor manufacturing incentives and funding for investment in research and programs the spur innovation in an effort to ensure that the U.S. remains at the forefront of technology leadership.

Expected Impact of the Chips & Science Act1

25%

Advanced Manufacturing Investment Tax Credit to Lower Cost Gap Between Investing in the U.S. and Abroad

$39 Billion

Manufacturing Incentive Program to Revitalize the Chipmaking Ecosystem

> $180 Billion

in company investments in the United States

> 200,000

jobs created across the United States

1Semiconductor Industry Association: 2022 State of the U.S. Semiconductor Industry

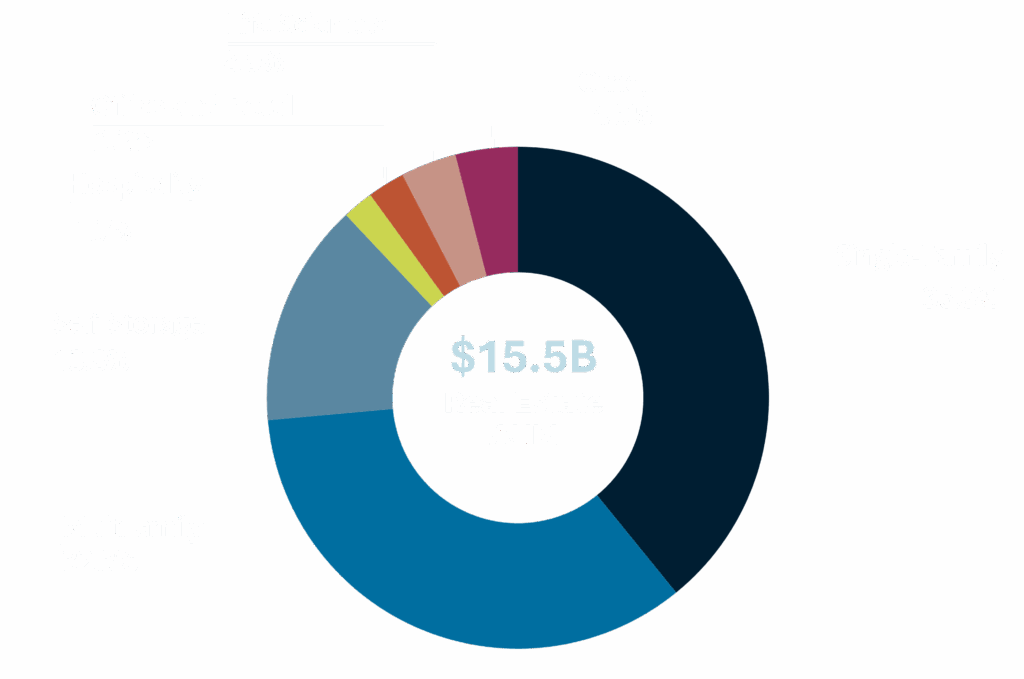

2021 Total Global Semiconductor Market: $556 Billion1

Percent of Semiconductor Demand, by End Use

The growth of new technologies and increasing data usage is driving demand for higher performance, more complex, and smaller chips. There is limited new supply of similar properties as the Property, with only roughly 75 institutional semiconductor fabrication facilities nationwide. As such, there is a significant shortfall in the number of available facilities to meet current and projected demand for the newer model of chips.

1Semiconductor Industry Association: 2022 State of the U.S. Semiconductor Industry

Prime Location

Temecula, California

The Property is located in Temecula, California, a city within the Riverside metropolitan statistical area (“MSA”).The Riverside MSA’s economy is expected to benefit from a stable to slightly growing population base. Since 2013, the Riverside MSA’s employment grew by 426,450 jobs, and it is expected that employment growth will continue in the future3. The city of Temecula is favorably situated, located only 85 miles from Los Angeles and 60 miles from San Diego. The city boasts of a diverse and rich manufacturing ecosystem with a growing number of companies moving to the area.

13th

Most Populous MSA2

4,647,703

2022 Population3

6.2%

GDP Growth in 20211

34.6%

Job Growth Since 20132

4.5%

Unemployment Rate2

6.2%

Avg. Household Income3

1. Bureau of Economic Analysis. The release of state and local GDP data has a longer lag time than national data. The data represents inflation-adjusted ‘real’ GDP stated in 2012 dollars. Per Capita GDP data are calculated by dividing the area GDP by its estimated population for the year shown. 2. Bureau of Labor Statistics, Temecula Industrial Real Estate Appraisal, June 13, 2023 3. Esri 2023, Compiled by JLL Valuation & Advisory Services, LLC.

41915 Business Park Drive

Skorpios Technologies Inc.’s Fabrication Plant

The Property included in this Offering is an industrial manufacturing property with one primary building, with two-stories and 69,000 square feet dedicated to clean rooms and 14,000 square feet designed specifically for lab space. The Property is one of the only 300mm scale wafer fabrication facilities in all of California, making it mission critical infrastructure.

28.77

Total Acres

344

Parking Spaces

450,000

Total Squarefeet

4

Dock High Doors

24'

Avg. Clearance Height

50'

Avg. Building Height

The Tenant

Skorpios Technologies Inc.

Skorpios is a semiconductor company distinguished by its pioneering approach to semiconductor manufacturing. Skorpios delivers highly integrated products based upon its proprietary technology known as Tru-SiPh™. The company designs, develops, and manufactures semiconductors in support of the entire silicon manufacturing ecosystem. Skorpios’ unique platform can be used to address a wide range of applications: high speed video, data and voice communications for networking, cloud computing, consumer, medical, and more.

The Tenant

Fact Facts1

2009

Year Founded

$110 B

Total Addressable Market

$39 M

Fiscal Year 2021 Revenue

125

Total Patents

17/40

PhDs/Engineers

~130

Total Employees

1. Skorpios Technologies Inc August 2022 Investor Presentation

Two Manufacturing Opportunities

Fabrication Services

Skorpios effectively acts as a semiconductor contract development and manufacturing organization (CDMO), providing fabrication services to other companies who do not have their own manufacturing footprint; fabrication services business has historically accounted for substantial majority of revenue and supported general and administrative expenses – on a run rate basis is expected to grow at ~10% per year and be modestly profitable on a standalone basis (~$10mm of EBITDA)1.

1. Skorpios Technologies Inc August 2022 Investor Presentation

Tru-SiPhTM Platform

Highly Differentiated Technology Offering Scalability for Next Generation Terabit Applications

Complete Integration of all Opto-Electronic Components in One Silicon Wafer

- Leveraging mature complementary metal oxide semiconductor (“CMOS”) Processes and large, highly-integrated silicon wafers

- III-V materials integrated into standard CMOS process

Massive Reliability Improvement and Power Reductions

- Incumbent discrete solutions: lower reliability and higher power dissipation

- Tru-SiPh™: heterogeneous photonic integrated circuit platform for low power dissipation, low cost, and high-reliability

- >40 year laser lifetime at worst-case conditions

Significantly Less Expensive to Manufacture

- Smaller, natively hermetic devices require no additional packaging

- Far lower-cost than photonic integration in traditional material systems

Tremendous Platform Scalability

- Tru-SiPh™ Platform: same manufacturing process for devices from 100G to 800G to 3.2Tb/s

- Faster development cycles, lower cost manufacturing

- Analogous to the silicon [integrated circuit industry

- Minimal cost increase going from 100G to 800G, leading to reduced R&D spend and smaller, more cost-effective devices

- 8 channels of 100G devices are integrated on a single transmitter chip and a single receiver chip

- Scalability advantage continues for next-gen applications

Skorpios In the News

Experts in Real Estate

Real Estate Track Record1

1. Real estate assets as of 03/31/2025, inclusive of affiliates. Past performance is not indicative of future results. 2. Real estate assets acquired from January 1, 2012 to March 31, 2025, inclusive of affiliates.

Experts in Real Estate

Management Team

Matthew McGraner

Chief Investment Officer

Matthew McGraner is a member of the investment committee for the Sponsor and serves in numerous roles across the NexPoint platform. With over ten years of real estate, private equity, and legal experience, his primary responsibilities are to lead the strategic direction and operations of the real estate platform at NexPoint. McGraner has led the acquisition and financing of approximately $18.4 billion of real estate investments.

Brian Mitts

Chief Financial Officer

Brian Mitts is a member of the investment committee for the Sponsor and serves in numerous roles across the NexPoint platform. Currently, Mitts leads NexPoint’s financial reporting and accounting teams and is integral in financing and capital allocation decisions. Mitts was also a co-founder of NREA, as well as NXRT and NexPoint Advisors, L.P., the parent of NREA. He has worked for NREA or one of its affiliates since 2007.

Paul Richards

Director, Real Estate

Paul Richards is a director for real estate at NexPoint Advisors, LP. His primary responsibilities are to research and conduct due diligence on new investment ideas, perform valuation and benchmarking analysis, monitor and manage investments in the existing real estate portfolio, and provide industry support for NexPoint’s Real Estate Team. He was previously a Product Strategy Associate and was responsible for evaluating and optimizing the registered product lineup.

Taylor Colbert

Director, Real Estate

Taylor Colbert is a director for real estate at NexPoint. He conducts due diligence and research on new investment ideas, performs valuation and benchmarking analysis, and manages investments in the existing real estate portfolio, providing support for NexPoint’s real estate team. Before joining NexPoint, he was an associate in private equity and senior fund analyst with a former NexPoint affiliate. Prior to this, he was employed by KPMG LLP as a senior audit associate in the Alternative Investment Group. He is a licensed CPA and a CFA charterholder.

For Financial Advisor Use Only

An investment in NexPoint Semiconductor Manufacturing DST (the “Trust” or “Offering”) is highly speculative, illiquid and involves substantial risk including the potential loss of your entire investment. The photos presented in this brochure are of the actual Property that is part of the Offering.

There are substantial risks in any investment program. See “Risk Factors” on page 16 of the accompanying PPM for a discussion of the risks relevant to this Offering. Distributions are not guaranteed. Please review the entire PPM prior to investing. Reference is made to the PPM for a statement of risks and terms of the Offering. The information set forth herein is qualified in its entirety by the PPM. All prospective Purchasers must read the PPM and no person may invest without acknowledging receipt and complete review of the PPM.

An investment in an Interest is highly speculative and involves substantial risks including, but not limited to:

- this is a “best-efforts” offering with no minimum raise or minimum escrow requirements;

- the lack of liquidity and/or public market for the Interests;

- the holding of a beneficial interest in the Trust with no voting rights with respect to the management or operations of the Trust or in connection with the sale of the Property;

- risks associated with owning, financing, operating and leasing an industrial manufacturing facility, and real estate generally, in California, and more specifically the Riverside MSA;

- the Property is located in a region with high seismic risk or potential, which increases the risk of damage to the Property;

- the Tenant is engaged in the business of semiconductor manufacturing which is a highly competitive business characterized by rapidly evolving technology and thus the Tenant’s financial instability will materially and adversely affect the Master Tenant’s and the Trust’s operations;

- risks associated with the impact of pandemics, including the COVID-19 pandemic, on the Property and the economies of the community in which the Property exists;

- under the Tenant Lease, the Tenant is allowed to make certain permitted alterations to the Property which could adversely affect the Master Tenant’s ability to re-tenant the Property to a new tenant;

- the Property is highly specific to the Tenant’s semiconductor manufacturing operations, which may adversely affect the Master Tenant’s ability to re-tenant the Property;

- the Trust depends on the Master Tenant for revenue, and the Master Tenant depends on the Tenant for revenue and thus any default by the Master Tenant or the Tenant will adversely affect the Trust’s operations;

performance of the Master Tenant under the Master Lease; - reliance on the Master Tenant and the Property Manager engaged by the Master Tenant, to manage the Property;

- risks associated with the Master Tenant’s finances, including its limited capital, limited operating history, and the Demand Note that capitalizes the Master Tenant;

- risks relating to the terms of the financing for the Property, including the use of leverage;

- the existence of various conflicts of interest among the Sponsor, the Trust, the Master Tenant, the Asset Manager, the Property Manager, and their affiliates;

- material tax risks, including treatment of the Interests for purposes of Code Section 1031 and the use of exchange funds to pay acquisition costs, which may result in taxable boot;

- the Interests not being registered with the SEC or any state securities commissions;

- risks relating to the costs of compliance with laws, rules and regulations applicable to the Property;

- lack of diversity of investment; and

- environmental risks related to the Property, including a REC found therein.

NexPoint Securities, Inc., an entity under common control with the Sponsor, serves as the Managing Broker-Dealer of the Offering. The Managing Broker-Dealer was formed in November 2013 and is registered as a broker-dealer with the SEC and is a member of FINRA/SIPC.

PLEASE CONTACT YOUR ADVISOR WITH ANY QUESTIONS ABOUT THIS OFFERING