NexPoint believes this Offering presents an attractive long-term investment opportunity in the Orlando MSA. The Offering is supported by strong population growth and housing demand, stable and rising household incomes, and proximity to world-renowned retail and entertainment destinations – all within one of the most visited and dynamic cities in the United States.

Quick Links

3rd Party Due Diligence Report

Coming Soon

Sign Selling Agreement via DocuSign

Request a Link to Sign Below

Marketing Materials

Offering

Snapshot

NexPoint believes this Offering presents an attractive long-term investment opportunity in the Orlando MSA. The Offering is supported by strong population growth and housing demand, stable and rising household incomes, and proximity to world-renowned retail and entertainment destinations – all within one of the most visited and dynamic cities in the United States.

Acquisition Details

Total Acquisition Cost*

$94,599,404

Total Controlled Reserves

$1,500,000

Lender Reserves**

$1,115,704

Total Capitalization

$98,957,175

Highlights of the Trust

Offering Size

$46,607,175

Minimum Purchase – Cash

$100,000

Minimum Purchase – 1031

$100,000

Suitability

Accredited Investors Only

Loan Information

Leverage to Investors

52.90%

Interest Rate

4.85% Fixed Rate

Loan Term

120 Months

Amortization

Interest Only for Full Term

* The Total Acquisition Cost includes the down payment for the Property, Loan-Related Costs, certain Lender Reserves, certain Trust controlled reserves, the Facilitation Fee, and Other Closing Costs.

** Lender Reserves refers to the Replacement Reserve and the Imposition Reserve which were required by the Lender.

Please review the entire Private Placement Memorandum (“PPM”) of NexPoint Oasis DST (the “Trust”) prior to investing. This material does not constitute an offer to sell. Reference is made to the PPM for a statement of risks and terms of the offering (the “Offering”) of the Interests. The information set forth herein is qualified in its entirety by the PPM. All potential Purchasers must read the PPM and no person may invest without acknowledging the receipt and complete review of the PPM.

Multifamily DSTs

Why We Believe in Multifamily DSTs

We believe multifamily DSTs represent a powerful intersection of stability, growth, and accessibility in real estate investing. These structures allow investors to participate in professionally managed, income-generating multifamily properties, while benefiting from tax deferral through Section 1031 Exchanges. As demand for quality rental housing continues to rise nationwide, we see multifamily DSTs as a strategic way to align investor goals with long-term market trends. This page explores why the multifamily sector is thriving, and how DSTs offer a smart, streamlined path to real estate ownership.

1.2% Rent Growth YOY1

Q2 Multifamily Absorption Surpasses 188,0001

$32 .9B

INVESTMENT VOLUME1

1CBRE Q2 2025 Report.

Multifamily Advantage

Multifamily real estate continues to perform well, offering consistent demand, scalable growth, and strong fundamentals that make it a standout investment in today’s market.

STRONG & STABLE DEMAND1

IMPROVING FINANCING CONDITIONS2

LOW VACANCY RATES3

AFFORDABILITY3

FOREIGN INTEREST4

1. CBRE Q2 2025 Report.

2. National Multifamily Housing Council, September 2025

3. CBRE, U.S. Real Estate Market Outlook 2025

4. Forbes, “How Are Foreign Investors Approaching the US Real Estate Market?” Oct 2, 2025

Offering Overview

Orlando MSA

The Orlando MSA is the fastest-growing among the top 30 U.S metros and ranked seventh nationally in total population gains in 20241. The Orlando MSA continues to show resilience and strategic growth, anchored by its thriving tourism sector and expanding healthcare and life sciences presence. The region benefits from strong business confidence and steady job creation. Its proximity to major institutions and infrastructure investments supports long-term economic stability. Overall, the Orlando MSA remains a dynamic and opportunity-rich market with momentum across key sectors.

1. OEP (Orlando Economic Population). Orlando Population Growth Highest in Nation, March 2025.

NEXPOINT OASIS DST

The Property

Oasis at Shingle Creek, the property held by the Trust (the “Property”), is a Class A garden-style multifamily community located in Kissimmee, FL, within the Orlando MSA. Developed by The Altman Companies, the Property consists of 356 units across 15 three-story apartment buildings, with 34% of units featuring private entries and 130 units offering direct access garages. The community includes a resort-style pool with private cabanas overlooking an interior lake, a clubhouse with a movie theatre and game room, a 24/7 fitness center, and spa-inspired unit interiors with quartz countertops and stainless-steel appliances. As of the most recent reporting, rents are positioned $150+ below comparable assets.

Luxury Living at Below-Market Rent

Resort-Style Amenities with Lake Views

Private Entries and Direct Access Garages

Download the brochure to view full property stats and amenities

BH Management

Established in 1993 by industry veteran Harry Bookey, BH Management has evolved into one of the nation’s top ten property management firms. With a robust infrastructure of over 1,700 employees and a portfolio exceeding 100,000 units, BH generates annual revenues of more than $400 million. Their proven track record in market analysis, resident satisfaction, and operational efficiency makes them a standout operator in the multifamily sector.

NexPoint has worked extensively with BH Management and holds deep confidence in their capabilities and strategic approach. Their commitment to quality and performance aligns seamlessly with our investment philosophy. BH currently manages over 377 multifamily communities, with a strong presence in high-growth southwestern and southeastern U.S. markets, regions that continue to demonstrate favorable demographic and economic trends.

1.2% Rent Growth YOY

Q2 Multifamily Absorption Surpasses 188,000

$32 .9B

INVESTMENT VOLUME

1. BHManagement.com

2. National Multifamily Housing Council

The NexPoint Approach

The Developer: Altman Companies

Altman Companies (“Altman”) bring decades of experience and a proven track record to the Offering, presenting a unique opportunity to partner with a premier developer of rental apartment and logistics communities across Florida and the Eastern United States. Through its integrated platforms, the company delivers best-in-class developments that respond to evolving market demands. Altman sets itself apart by combining modern design, luxury finishes, and resort-style amenities with high-touch service and thoughtful community planning. With over 28,000 apartment homes developed and deep institutional relationships, Altman continues to redefine residential and logistics real estate through innovation, quality, and strategic execution.

Experts in Real Estate

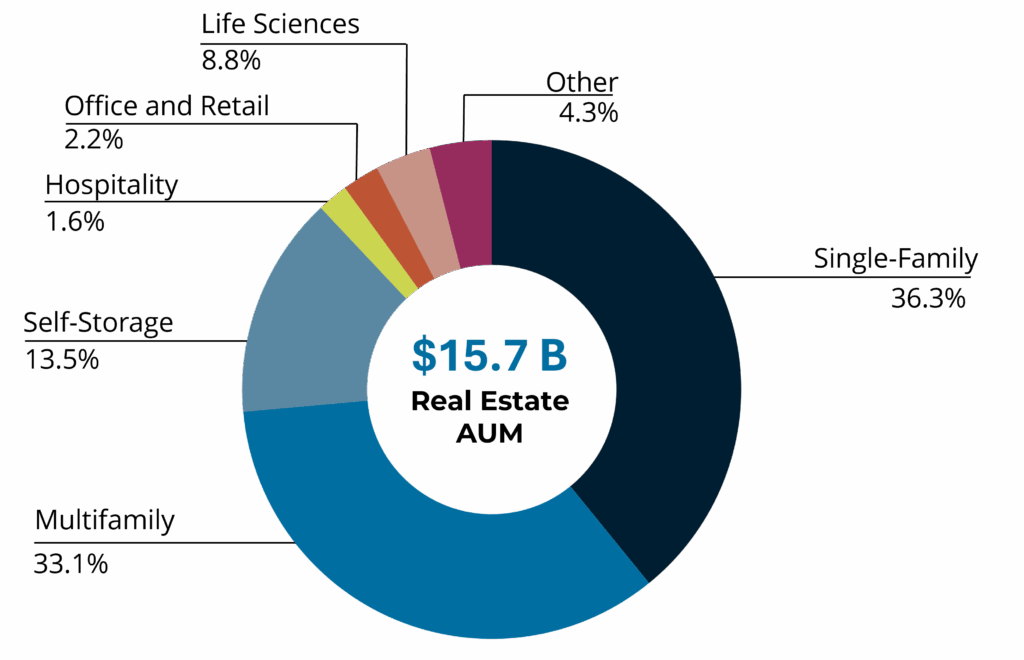

Real Estate Track Record1

1. Real estate assets as of 09/30/2025, inclusive of affiliates. Past performance is not indicative of future results. 2. Real estate assets acquired from January 1, 2012 to September 30, 2025, inclusive of affiliates.

EXPERTS IN REAL ESTATE

Management Team

Matthew McGraner

President

Matthew McGraner is Chief Investment Officer at NexPoint Advisors, where he leads the strategic direction and operational execution of the firm’s real estate investment platform. With decades of experience spanning real estate, private equity, and law, Mr. McGraner plays a central role in sourcing and structuring investments, managing risk, and driving growth through fundraising, private placements, and joint ventures. Under his leadership, NexPoint has executed and financed approximately $18.4 billion in real estate transactions across diverse asset classes. His multidisciplinary background and deep industry insight continue to shape NexPoint’s investment strategy and expansion into new opportunities.

Paul Richards

Chief Financial Officer

Paul Richards is CFO at NexPoint Advisors, where he is responsible for overseeing all financial operations and capital management, driving strategic financial planning, managing investor relations, and guiding the firm’s fiscal health to support long-term growth and stakeholder value. Since joining NexPoint in 2014, he has led valuation analysis, product strategy, portfolio management, and due diligence efforts supporting billions in real estate transactions. Paul holds a B.S. in Accounting and an M.S. in Finance from Texas A&M University and is a licensed CPA.

D.C. Sauter

General Counsel

D.C. Sauter is General Counsel for Real Estate for NexPoint Advisors, L.P. Prior to joining NexPoint, he was a partner with Wick Phillips Gould & Martin, LLP, where his practice focused on all aspects of commercial real estate, including acquisitions, dispositions, entitlements, construction, financing, and leasing of industrial, office, retail, hotel, and multifamily assets. In addition to transactional matters, Sauter has significant experience in complex commercial disputes, foreclosures, and workouts.

Bonner McDermett

Director, Real Estate

Bonner McDermett serves as Director of Multifamily at NexPoint Advisors and SVP of Asset Management at NexPoint Residential Trust, overseeing operations for a 27,000+ unit multifamily portfolio. He leads strategy, sourcing, and execution for new acquisitions, having played a key role in over $6.5 billion in transactions. Prior to joining NexPoint in 2015, he was a Financial Analyst at ARA, where he evaluated $8 billion in assets and supported $2.4 billion in closings. He holds a B.A. from the University of Texas

Any investment in NexPoint Oasis DST, a Delaware Statutory Trust (“DST”), is highly speculative, illiquid, and involves a high degree of risk, including the potential loss of your entire investment. The photos in this brochure are of the actual Property in this Offering and the Orlando MSA. There are substantial risks in any investment program. This is not an offer to sell securities or a solicitation of an offer to buy securities.

An offer to sell interests (“Interests”) in NexPoint Oasis DST (the “Trust”) may be made only pursuant to the PPM, which is available upon request. Distributions are not guaranteed. Please review the entire PPM prior to investing. Reference is made to the PPM for a statement of risks and terms of the Offering. The information set forth herein is qualified in its entirety by the PPM. All potential investors must read the PPM and no person may invest without acknowledging receipt and complete review of the PPM. The offering of Interests (the “Offering”) is being made by means of the PPM only to accredited investors who meet minimum accreditation requirements, as well as suitability standards as determined by a qualified broker-dealer or investment advisor. The contents of this communication may not be relied upon in making an investment decision related to this Offering. All prospective investors must read the PPM, including the “Risk Factors” section, any discussion of fees and expenses, and other pertinent information prior to investing. These investment opportunities have not been registered under the Securities Act of 1933 and are being offered pursuant to an exemption therefrom and from applicable state securities laws.

An investment in an Interest is highly speculative and involves substantial risks including, but not limited to:

this is a “best-efforts” offering with no minimum raise or minimum escrow requirements;

• the lack of liquidity and/or a public market of the Interests;

• the holding of a beneficial interest in the Trust with no voting rights with respect to the management or operations of the Trust or in connection with the sale of the Property;

• risks associated with owning, financing, operating and leasing a multifamily apartment complex and real estate generally in the Orlando–Kissimmee-Sanford, Florida Metropolitan Statistical Area (the “Orlando MSA”);

• the Property is located in a “Hurricane Susceptible Region,” which increases the risk of damage to the Property;

• risks associated with the Exchange Right;

• risks associated with general market fluctuations such as recessions (global or local), the impact of pandemics (including the COVID-19 pandemic), and other systemic market or economic fluctuations of the communities in which the Property exists;

• the Trust depends on the Master Tenant for revenue, and the Master Tenant depends on the end-user tenants for revenue and thus any default by the Master Tenant or the end-user tenants will adversely affect the Trust’s operations;

• performance of the Master Tenant under the Master Lease, including the potential for the Master Tenant to defer a portion of rent payable under the Master Lease;

• reliance on the Master Tenant and the Property Manager engaged by the Master Tenant, to manage the Property;

• risks associated with the Sponsor funding the Demand Note that capitalizes the Master Tenant;

• risks relating to the terms of the financing for the Property, including the use of leverage;

• lack of diversity of investment;

• the existence of various conflicts of interest among the Sponsor, the Trust, the Master Tenant, the Property Manager, and their affiliates;

• material tax risks, including treatment of the Interests for purposes of Code Section 1031 and the use of exchange funds to pay acquisition costs, which may result in taxable boot;

• the Interests not being registered with the Securities and Exchange Commission (the “SEC”) or any state securities commissions;

• risks relating to the costs of compliance with laws, rules and regulations applicable to the Property;

• risks related to competition from properties similar to and near the Property; and

• the possibility of environmental risks related to the Property.

NexPoint Securities, Inc., an entity under common control with the Sponsor, serves as the Managing Broker-Dealer of the Offering. The Managing Broker-Dealer was formed in November 2013 and is registered as a broker-dealer with the SEC and is a member of FINRA/SIPC.