Series B Cumulative Redeemable Preferred Stock

NexPoint Real Estate Finance Inc. is a commercial mortgage real estate investment trust concentrating on investments in real estate sectors where senior management has operating expertise, including multifamily, single-family rental (”SFR”), self-storage, life science, and manufacturing sectors in the top 50 metropolitan statistical areas.

Quick Links

3rd Party Due Diligence Report

Now Available

Sign Selling Agreement via DocuSign

Request a Link to Sign Below

Offering Terms

ABOUT NREF

NexPoint Real Estate Finance, Inc. (NREF) is a commercial mortgage real estate investment trust (REIT), with its shares of common stock listed on the New York Stock Exchange under the symbol “NREF.” The company is primarily focused on investments in real estate sectors where its senior management team has operating expertise, including in the multifamily, single-family rental, self-storage, life sciences and manufacturing sectors, predominantly in the top 50 metropolitan statistical areas.

Offering Size

$400 Million

Price Per Share

$25.00

Investment Minimums

Qualified Accounts: $5,000

Non-Qualified Accounts: $5,000

Annual Dividend

9% Annual Dividend; Paid Monthly1

Tax Reporting

Form 1099

Company Redemption Terms2

After 2 years, NREF may redeem for Liquidation Value in cash or shares of common stock

Stockholder Redemption Terms2

Upon Issuance, for Liquidation Value, less a 12% redemption fee;

After 1 year, for Liquidation Value, less a 9% redemption fee;

After 2 years, for Liquidation Value, less a 6% redemption fee;

After 3 years, for Liquidation Value, less a 3 % redemption fee;

After 4 years, for Liquidation Value

1. Payment of dividends is not guaranteed. Dividends may be paid from sources other than cash flow from operations. 2. Holder redemptions may begin on the first day of the month following initial issuance. Redemption pricing starts on the first day of the month following the applicable hold period.

NYSE:NREF, MORTGAGE REIT

NREF Company Highlights

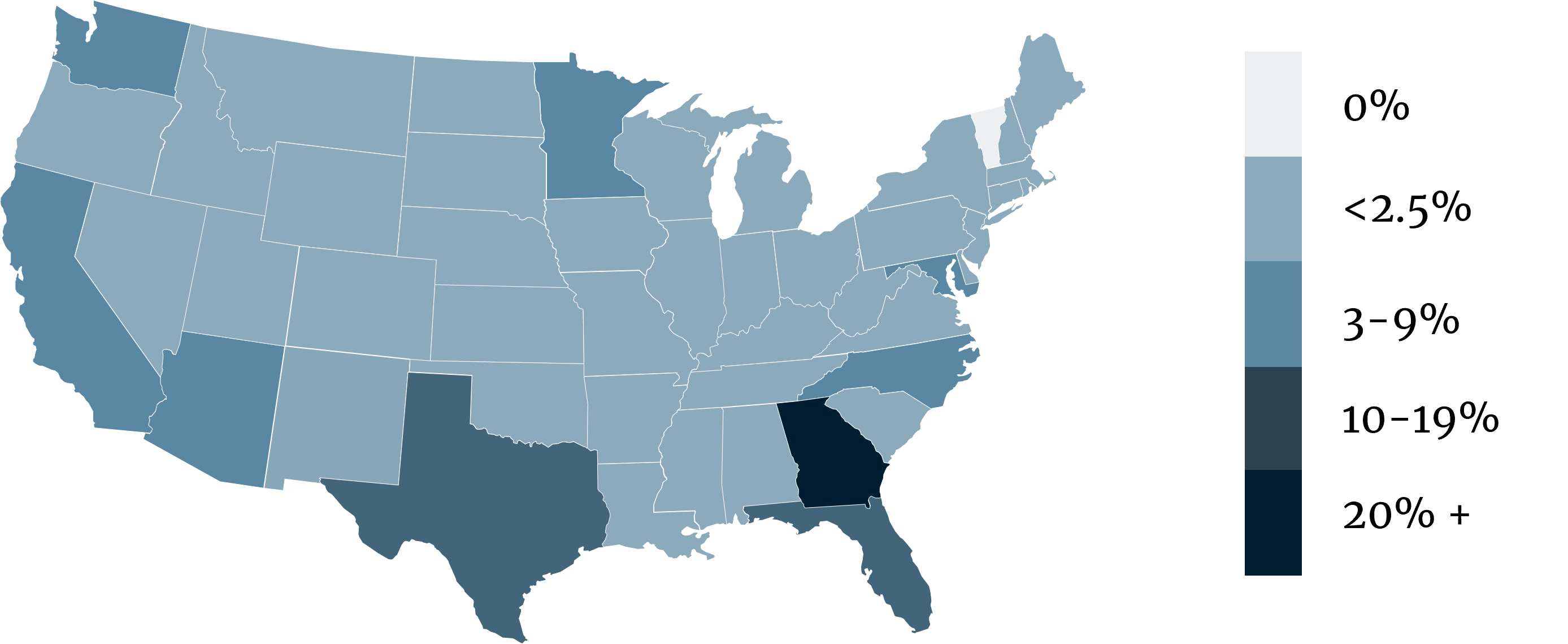

PERCENTAGE OF TOTAL OUTSTANDING PRINCIPAL BALANCE

86.6%

% OF PORTFOLIO STABILIZED1

5.3 Years

AVERAGE REMAINING TERM1

1.74X

WEIGHTED AVERAGE DEBT SERVICE COVERAGE RATIO1

12.0%

OWNED BY MANAGEMENT AND EMPLOYEES2

1. As of March 31, 2024 and excluding common stock investments and the Hudson Montford and Alexander at the District Multifamily Properties. See “Weighted Average Debt Service” in the Risks and Disclosures section on page 7.

2. Includes non-controlling interests. excludes ownership by funds advised or managed by affiliates or our adviser except to the extent of our management’s pecuniary interest therein as of the close of trading May 1, 2024.

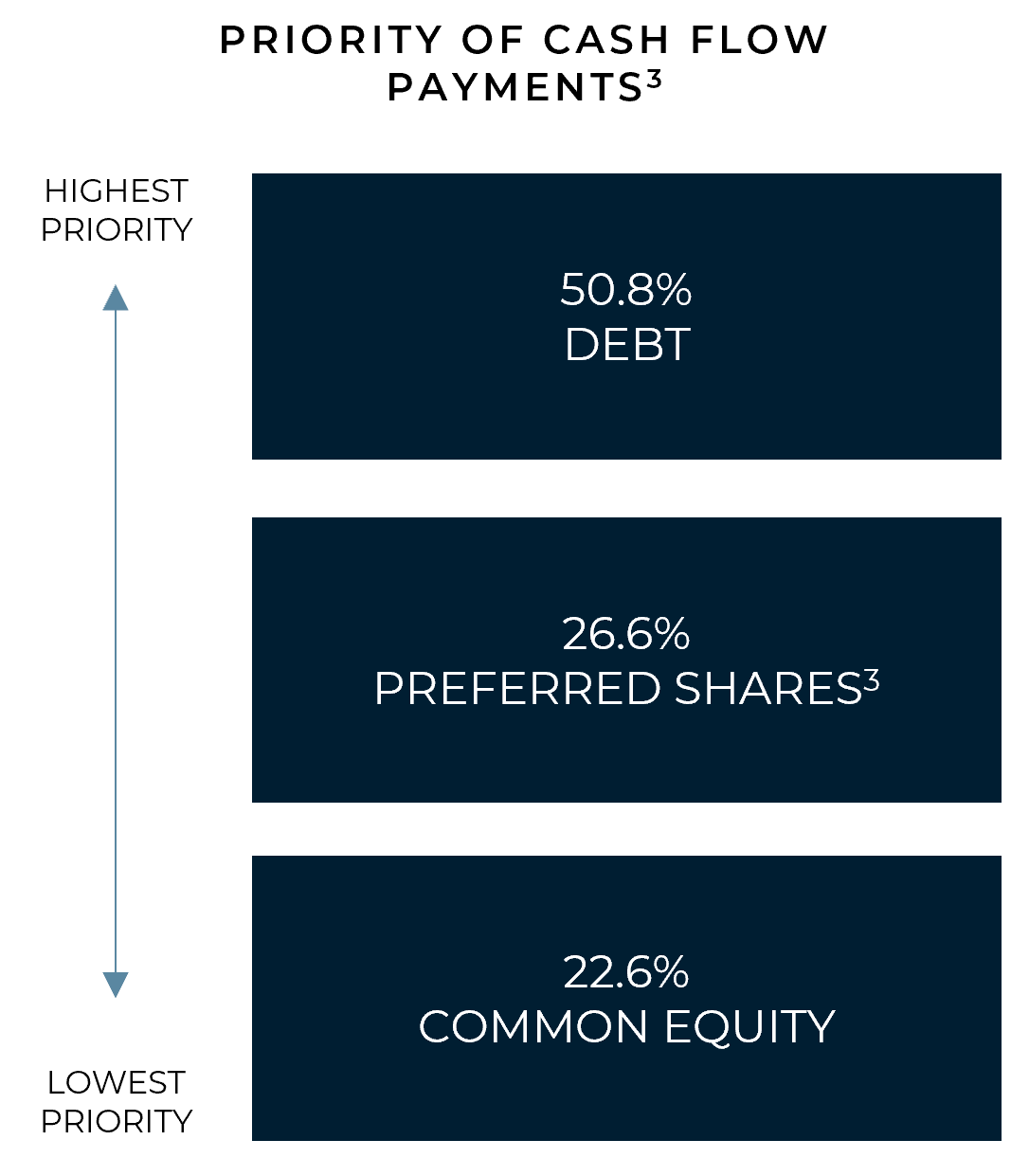

3. As of March 31, 2024. The capital stack assumes 1Q24 financial position as well as a $400MM of Series B preferred is raised in the future. Our Board has the authority to issue shares of additional classes or series of preferred stock that could be senior in priority to the Series B Preferred Stock.

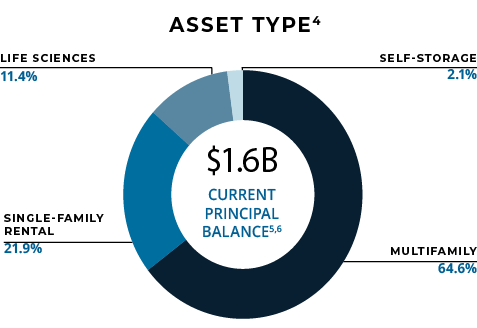

4. As of March 31, 2024. $40.9MM of Series B Preferred Stock raised.

NYSE:NREF, MORTGAGE REIT

Diverse Portfolio of Investments

INVESTMENT OBJECTIVE

Our primary investment objective is to generate attractive, risk-adjusted returns for stockholders over the long term. We intend to achieve this objective primarily by originating, structuring and investing in our target assets. We target lending or investing in properties that are stabilized or have a light transitional business plan with positive DSCRs and high-quality sponsors.

Through active portfolio management we seek to take advantage of market opportunities to achieve a superior portfolio risk-mix that delivers attractive total returns. Our Manager regularly monitors and stress-tests each investment and the portfolio as a whole under various scenarios, enabling us to make informed and proactive investment decisions.

NYSE:NREF, MORTGAGE REIT

Diverse Portfolio of Investments

NREF focuses on asset classes that with strong fundamentals and performance in an inflationary, rising interest rate environment

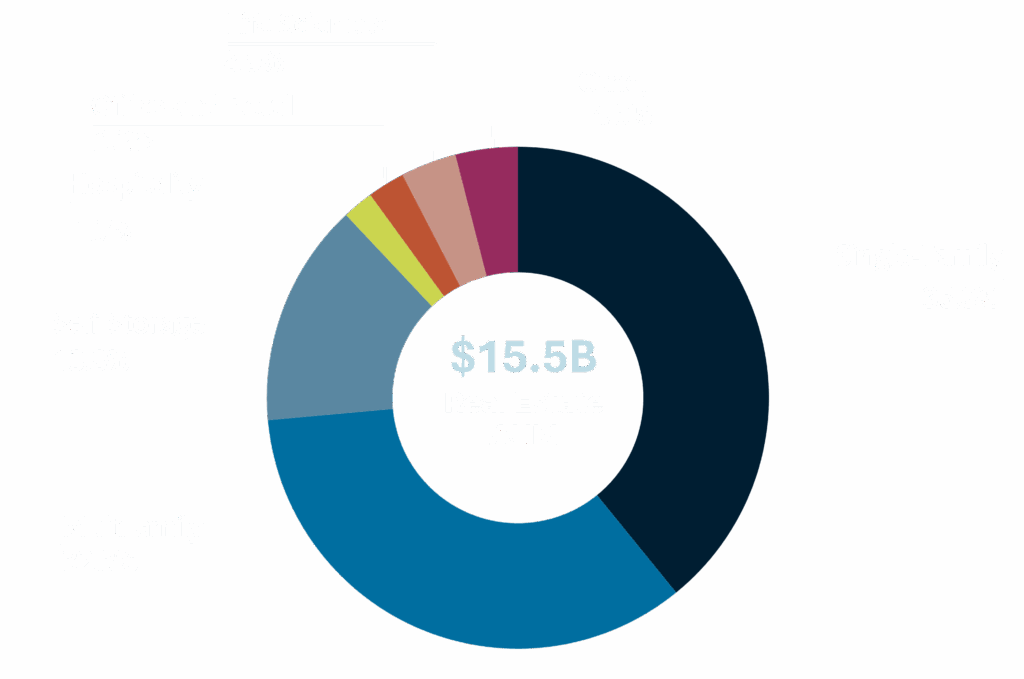

50.4%

MULTIFAMILY

44.0%

SINGLE-FAMILY RENTAL

4.1%

LIFE SCIENCES

1.5%

SELF-STORAGE

MULTIFAMILY

Multifamily investments are marked by remarkably low losses on debt issuances secured by multifamily assets, even during periods of market stress. With aggregate losses averaging just 2 basis points per year dating back to 2009.1 This asset class has demonstrated resilience. Occupancies in this sector remain at all-time highs, with strong underlying fundamentals.

SINGLE-FAMILY RENTAL

Single-Family Rental investments share a similarity to multifamily assets in terms of stability and potential. With high occupancies and robust fundamentals, SFR investments showcase resilience and steady growth potential. SFR loan portfolio offers a strong interest rate spread. This asset class is also part of the Freddie Mac forbearance program, designed to mitigate cash flow interruptions for bondholders.

LIFE SCIENCES

Advances in technology, increased spending in the field, and a growing pool of medical talent have created substantial demand for real estate that meets the unique and specific requirements of the life sciences sector. This asset class presents an opportunity for steady growth and stability, driven by long-term demand trends.

SELF-STORAGE

Self-storage investments have historically outperformed other real estate asset types during economic downturns. Record-high occupancies and strong demand contribute to its continued success. Amid economic challenges, self-storage remains a reliable and promising investment opportunity.

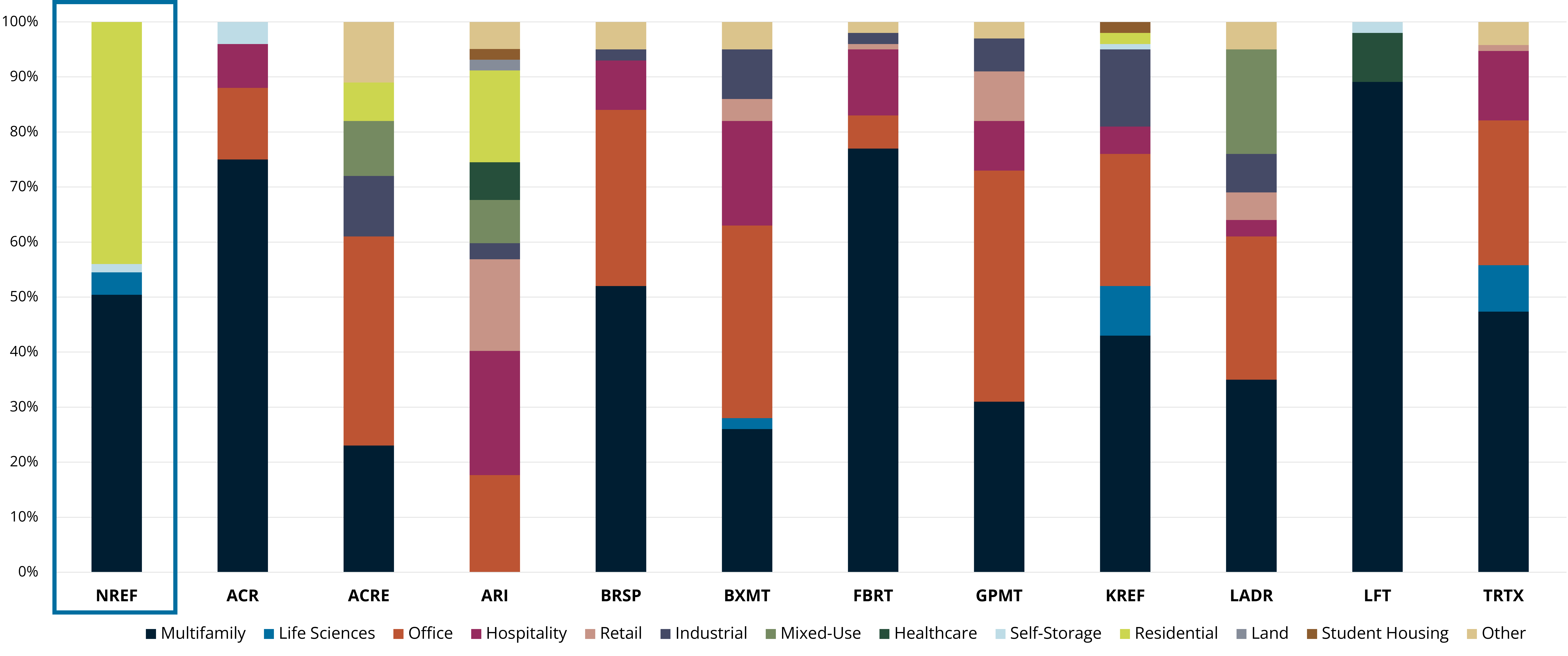

NREF’s Portfolio is Well-Balanced in Desirable Property Types Compared to Competitors

NREF invests in desirable and resilient property types: multifamily, self-storage, single-family rental, and life sciences

with zero office, retail, hotel exposure.

1. Freddie Mac K-Deals Performance; 200- August 2023

EXPERTS IN REAL ESTATE

Public Market Expertise

NexPoint and its affiliates advise 4 publicly traded REITs and 3 private REITs, which have a combined $12.7 billion of AUM1

NYSE:NXRT

NexPoint Residential Trust

NexPoint Residential Trust, Inc. (“NXRT”) is focused on the acquisition, asset management, and disposition of multifamily assets, located primarily in the Sun Belt region of the United States.

NYSE:NXDT

NexPoint Diversified Real Estate Trust

NexPoint Diversified Real Estate Trust (“NXDT”) is a diversified REIT aiming to provide both current income and capital appreciation by investing among various commercial real estate property types and across the capital structure, including mortgage debt, mezzanine debt and common and preferred equity and more.

NYSE:NREF

NexPoint Real Estate Finance

NexPoint Real Estate Finance, Inc. (“NREF”) is primarily focused on investments in real estate sectors where its senior management team has operating expertise, including in the multifamily, single-family rental, or SFR, self-storage, hospitality and office sectors predominantly in the top 50 metropolitan statistical areas.

TVX:NHT.U

NexPoint Hospitality Trust

NexPoint Hospitality Trust (“NHT”) is a publicly traded Real Estate Investment Trust, focused on acquiring and maintaining, mostly select service and extended stay, hospitality assets in the United States.

1. As of 6/30/2023

Experts in Real Estate

Real Estate Track Record1

1. Real estate assets as of 03/31/2025, inclusive of affiliates. Past performance is not indicative of future results. 2. Real estate assets acquired from January 1, 2012 to March 31, 2025, inclusive of affiliates.

NEXPOINT MANAGEMENT TEAM

Experts in Real Estate

“We are committed to deploying capital in asset classes where we see opportunity for investors and where our senior management team has extensive experience.

Our dedication to delivering value to our shareholders is evident in the performance of

Matthew McGranerChief Investment Officer

the company.”

JANUARY 27, 2020

NexPoint Real Estate Finance, Inc. Announced Launch of Initial Public Offering

The shares began trading on the New York Stock Exchange on February 7, 2020, under the ticker symbol “NREF.“ The NexPoint team traveled to New York to ring the opening bell in early 2020.

NREA Team

25+ PERSON TEAM DEDICATED TO REAL ESTATE

Mr. McGraner and Mr. Mitts are supported by a team of 25+ investment and back office personnell with extensive experience in accounting, finance, marketing, investor relations, law, and capital markets in the real estate space. The NREA team maintains relationships with industry-leading firms to achieve the best possible returns for our investors and partners.

For Due Diligence Use Only

Payment of dividends is not guaranteed. Dividends may be paid from sources other than cash flow from operations. Dividends may represent a return of capital.

The security investment described herein relates solely to the Series B Cumulative Redeemable Preferred Stock (“Series B Preferred Stock”) of NexPoint Real Estate Finance, Inc. (“NREF”), a non-traded security of NREF which has not been nor is expected to be listed on any national exchange. The risks and rewards of investing in NREF’s Series B Preferred Stock are separate and distinct from an investment in NREF’s common stock or Series A Cumulative Redeemable Preferred Stock (“Series A Preferred Stock”), both of which are listed on the New York Stock Exchange.

THIS IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY THE SECURITIES DESCRIBED HEREIN. AN OFFERING IS MADE ONLY BY THE PROSPECTUS AND ANY ACCOMPANYING PROSPECTUS SUPPLEMENT. THIS SALES AND ADVERTISING LITERATURE MUST BE READ IN CONJUNCTION WITH OR ACCOMPANIED BY THE PROSPECTUS AND ANY ACCOMPANYING PROSPECTUS SUPPLEMENT IN ORDER TO UNDERSTAND FULLY ALL OF THE IMPLICATIONS AND RISKS OF THE OFFERING OF SECURITIES TO WHICH IT RELATES. A COPY OF THE PROSPECTUS AND ANY ACCOMPANYING PROSPECTUS SUPPLEMENT MUST BE MADE AVAILABLE TO YOU IN CONNECTION WITH THE OFFERING. NONE OF THE U.S. SECURITIES AND EXCHANGE COMMISSION (“SEC”), OR ANY OTHER STATE REGULATORS HAVE PASSED ON OR ENDORSED THE MERITS OF THE OFFERING. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

NREF is a publicly traded real estate investment trust (REIT), with its common stock listed on the New York Stock Exchange under the symbol “NREF” primarily focused on originating, structuring and investing in first-lien mortgage loans, mezzanine loans, preferred equity, convertible notes, multifamily properties and common stock investments, as well as multifamily commercial mortgage-backed securities securitizations, multifamily structured credit risk notes and mortgage-backed securities.

An investment in NREF involves substantial risk. See the “Risk Factors” sections of the Prospectus and any accompanying Prospectus Supplement for a discussion of material risks related to an investment in NREF’s Series B Preferred Stock, which include, but are not limited to, the following:

- There is currently no public trading market for our Series B Preferred Stock, and one may never exist; therefore, a holder’s ability to dispose of shares of Series B Preferred Stock will likely be limited.

- Because we conduct substantially all of our operations through NexPoint Real Estate Finance Operating Partnership, L.P. (“OP”), our ability to pay dividends on our Series B Preferred Stock depends almost entirely on the distributions we receive from the OP. We may not be able to pay dividends regularly on our Series B Preferred Stock.

- The rights of the holders of our Series B Preferred Stock or of our common stock (which holders of Series B Preferred Stock may become upon receipt of redemption payments in shares of our common stock for any shares of Series B Preferred Stock) could be subordinated and/or diluted by the incurrence of additional debt or the issuance of additional shares of preferred stock or common stock, as applicable, and other transactions.

- The Company’s 5.75% Senior Unsecured Notes due 2026, the OP’s 7.50% Senior Unsecured Notes due 2025 and future offerings of debt securities or shares of our capital stock expressly designated as ranking senior to our Series B Preferred Stock as to distribution rights and rights upon our liquidation, dissolution or winding up may adversely affect value of our Series B Preferred Stock.

- The Series B Preferred Stock has not been rated.

- In the event a holder of our Series B Preferred Stock exercises their redemption option we may redeem such shares of Series B Preferred Stock either for cash, or for shares of our common stock, or any combination thereof, in our sole discretion.

- Dividend payments on the Series B Preferred Stock are not guaranteed. We may use borrowed funds or funds from other sources to pay dividends, which may adversely impact our operations.

- We intend to use the net proceeds from the offering of the Series B Preferred Stock to fund future investments and for other general corporate purposes, but the offering will not be conditioned upon the closing of pending property investments and we will have broad discretion to determine alternative uses of proceeds.

- The Series B Preferred Stock will bear a risk of early redemption by us.

- There is a no guarantee we will exercise our option to redeem all or a portion of the Series B Preferred Stock in connection with a Change of Control.

- Holders of the Series B Preferred Stock will be subject to inflation risk.

- Holders of the Series B Preferred Stock have extremely limited voting rights.

- The amount of the liquidation preference is fixed and holders of Series B Preferred Stock will have no right to receive any greater payment.

- Our charter, including the Articles Supplementary establishing the Series B Preferred Stock, contains restrictions upon ownership and transfer of such preferred stock and shares of our common stock which may be issued upon the redemption of shares of Series B Preferred Stock, at the Company’s option.

- Our ability to pay dividends or redeem shares is limited by the requirements of Maryland law.

- If our common stock and the Series A Preferred Stock are no longer listed on the NYSE or another national securities exchange, we may be required to terminate any continuous offering(s) of Series B Preferred Stock.

- To the extent that our distributions represent a return of capital for tax purposes, stockholders may recognize an increased gain or a reduced loss upon subsequent sales (including cash redemptions) of their shares of Series B Preferred Stock.

- Holders of Series B Preferred Stock may recognize dividend income on constructive dividends without a corresponding cash payment.

- Shares of Series B Preferred Stock may be redeemed for shares of our common stock, which rank junior to the Series B Preferred Stock with respect to dividends and upon liquidation.

- We established the offering price for the Series B Preferred Stock pursuant to discussions among us and our affiliated dealer manager; as a result, the actual value of an investment in the Series B Preferred Stock may be substantially less than the amount paid.

- The dealer manager’s relationship with us and the payment to it of substantial commissions and fees in connection with this offering may cause a conflict of interest and may hinder the dealer manager’s performance of its due diligence obligations.

- If we fail to pay dividends to holders of our preferred stock or otherwise lose our eligibility to file registration statements on Form S-3 with the SEC, it may impair our ability to raise capital in the Series B Preferred Stock offering.

- Compliance with the SEC’s Regulation Best Interest by participating broker-dealers may negatively impact our ability to raise capital in the Series B Preferred Stock offering, which could harm our ability to achieve our investment objectives.

Additional material risks related to an investment in NREF’s Series B Preferred Stock include other risks under Part I, Item 1A, “Risk Factors” in NREF’s Annual Report on Form 10-K filed with the SEC, as such risk factors may be amended, supplemented or superseded from time to time by other reports we file with the SEC. You should review these risk factors and the risk factors in the Prospectus and any accompanying Prospectus Supplement carefully before investing in the Series B Preferred Stock.

NREF has a shelf registration statement on Form S-3 (No. 333-263300) that the SEC declared effective on March 14, 2022, pursuant to which the offering of the Series B Preferred Stock is being made. A copy of the Prospectus and any accompanying Prospectus Supplement must be made available to you in connection with the offering of the Series B Preferred Stock and must be read in conjunction with these materials in order to fully understand the risks of an investment in the offering.

Summary of Fees and Expenses: Investors will be subject to the following fees and expenses as part of the offering: selling commissions, dealer manager fee, and other offering expenses. Please see the Prospectus and any accompanying Prospectus Supplement for a complete listing of all fees and expenses related to the offering.

The materials contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include statements regarding the payment of dividends, the Company’s intent not to list the Series B Preferred Stock, certain risks related to the Series B Preferred Stock and other statements identified by words such as “expect,” “intend,” “may,” “will,” “could,” the negative version of these words and similar expressions that do not relate solely to historical matters. Forward-looking statements are based on NREF’s current expectations and assumptions regarding capital market conditions, NREF’s business, the economy and other future conditions. Forward-looking statements are subject to risks, uncertainties and assumptions and may be affected by known and unknown risks, trends, uncertainties and factors that are beyond NREF’s control. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, estimated or projected. Important factors that could cause actual results to differ materially from those in the forward-looking statements include regional, national or global political, economic, business, competitive, market and regulatory conditions, and those described in greater detail in our filings with the SEC, particularly those described in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Readers should not place undue reliance on any forward-looking statements and are encouraged to review the Company’s Annual Report on Form 10-K and the Company’s other filings with the SEC for a more complete discussion of risks and other factors that could affect any forward-looking statement. Any forward-looking statement made on this website speaks only as of the date on which it is made. NREF undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.