This Offering includes two strategically selected Small Bay Properties with high occupancy rates in Orlando, Florida.

Quick Links

3rd Party Due Diligence Report

Coming Soon

Sign Selling Agreement via DocuSign

Request a Link to Sign Below

Offering

Snapshot

This Offering features a portfolio of two small bay industrial properties located in Orlando – Kissimmee – Sanford metropolitan statistical area (“MSA”), Florida. NexPoint believes that Small Bay properties have an advantage over traditional warehouses or industrial facilities, which generally have a concentrated tenant base with long-term leases. Small Bay properties tend to be located in more densely-populated infill areas and benefit from higher barriers to entry and replacement costs. Tenant leases of Small Bay properties are generally for a shorter term, which allows rents to adjust more quickly to market and new demand conditions. These leases typically have annual contractual rent escalations, promoting steady rent growth through the life of the lease.

Acquisition Details

Total Acquisition Cost1

$73,550,014

Total Capitalization

$77,175,526

Lender Reserves2

$5,212,079

Highlights of the Trust

Offering Size

$38,775,526

Minimum Purchase – Cash

$100,000

Minimum Purchase – 1031

$100,000

Suitability

Accredited Investors Only

Loan Information

Loan Amount

$38,400,000

Loan-to-Capitalization3

49.8%

Interest Rate

6.535% Fixed Rate

Amortization

Interest Only for Full Term

1. The Total Acquisition Cost includes the purchase price under the Lakefront PSA and the Belle PSA, the Loan-Related Costs, the Other Closing Costs, the Lender Reserves, and the Working Capital Reserve. 2. Lender Reserves refers to the Capital Expense/Rollover Reserve, Imposition Reserve, Required Repairs Reserve, Free and prepaid Rent Reserve. 3. The loan-to-capitalization ratio (“LTC”) is the ratio of a loan to the capitalization of an asset purchased. For instance, if someone borrows $80,000 to purchase a property worth $100,000, the LTC ratio is $80,000 to 100,000 or $80,000/100,00, or 80%.

There are substantial risks in any investment program. See ‘‘ Risk Factors” on page 20 of the PPM for a discussion of the risks relevant to the Offering.

Please review the entire PPM prior to investing. This material does not constitute an offer to sell. Reference is made to the PPM for a statement of risks and terms of the Offering. The information set forth herein is qualified in its entirety by the PPM. All potential Purchasers must read the PPM and no person may invest without acknowledging the receipt and complete review of the PPM.

Small Bay Real Estate

An Asset Class for an Underserved Tenant Base

Small bay properties are often referred to as multi-tenant warehousing or light industrial properties, and are typically smaller than standard facilities. Roughly 20% of a small bay property is used as an office, and the other 80% is used as a warehouse. The tenants of small bay properties range from small “mom-and-pop” businesses in local distribution, construction, light industrial, and service industries to Fortune 500 companies whose spaces typically average about 2,500 square feet.

UNDERVALUED

ASSET CLASS

LIMITED

INSTITUTIONAL

COMPETITION

SUPERIOR

LOCATIONS

CONTINUED MARK-TO-MARKET OPPORTUNITIES

Diversified Tenant Base

HIGHLY

FRAGMENTED

HIGH BARRIERS TO ENTRY

STRONG

LEASING

MOMENTUM

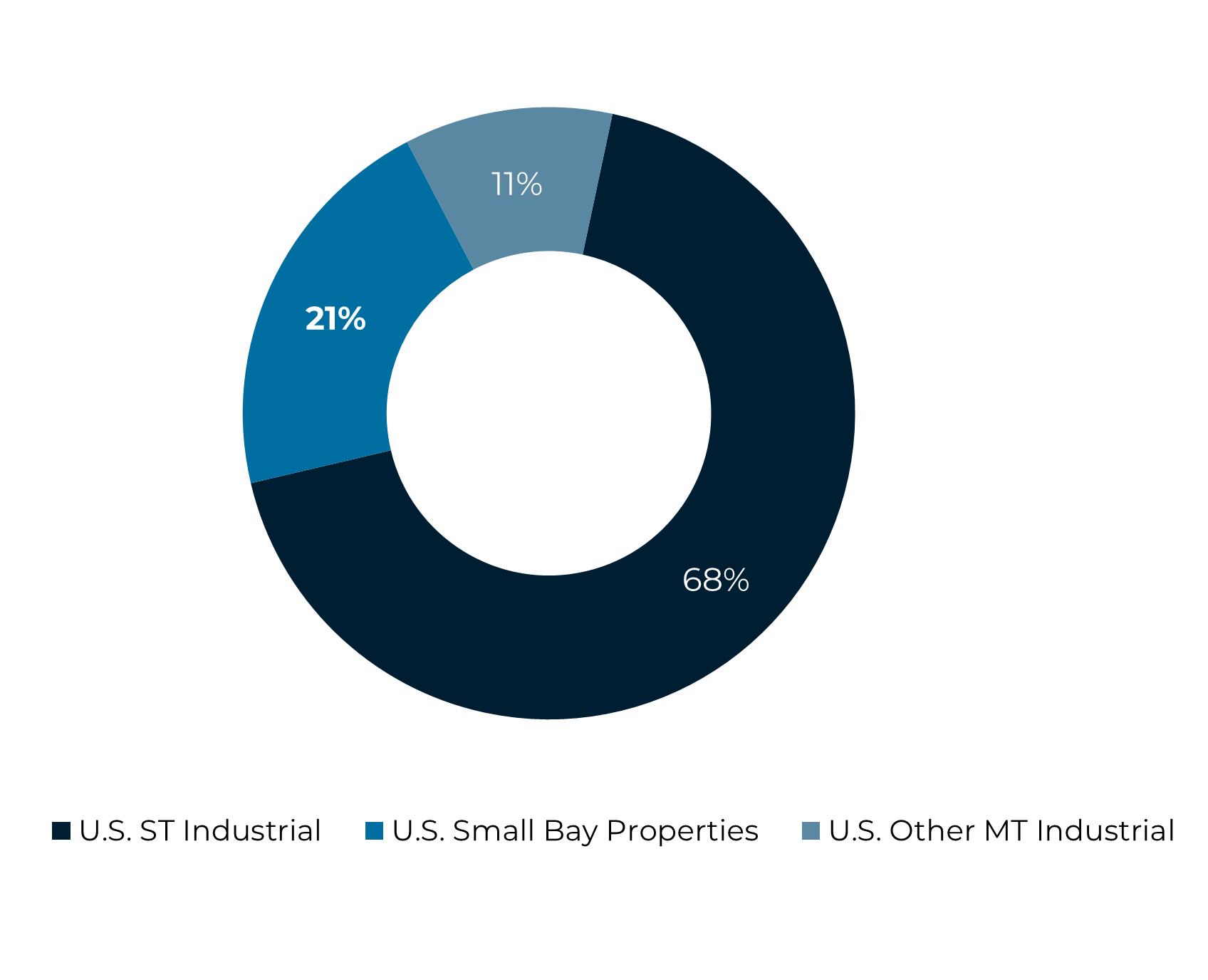

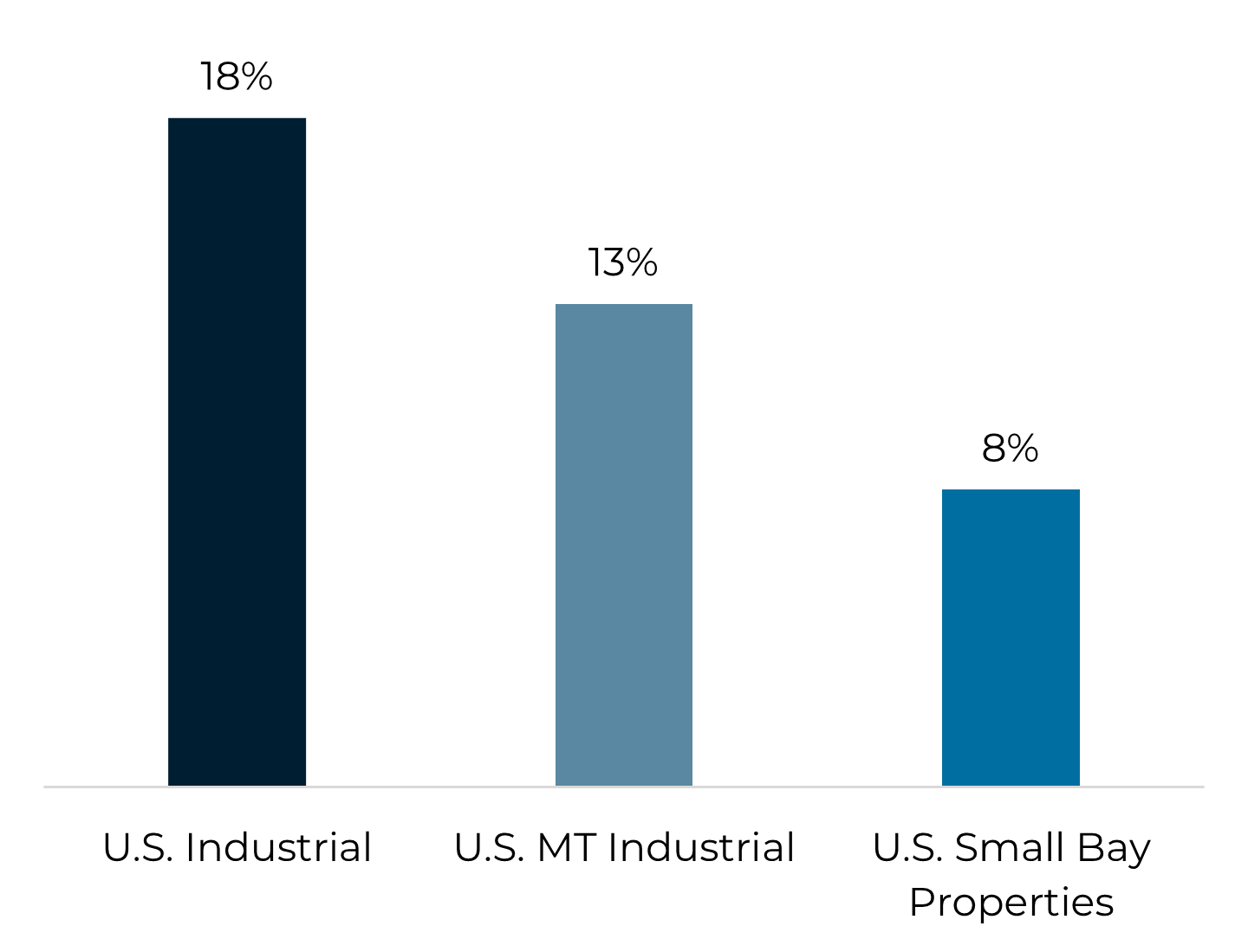

This asset class, however, we believe is still undervalued by institutional investors. Institutional investors are underweight in this industrial market segment, as Small Bay Properties account for only 9.7% of institutional industrial investments.1

2023 Inventory Breakdown1

% Growth in SF Inventory 2012-20232

1. CBRE: The Case for Small Bay Warehouse 2. JLL, Shallow Bay Industrial Report, September 2023

The Orlando Property is located in the Orlando metropolitan statistical area (“MSA”). The Orlando MSA is 3,491 square miles in size and ranks 20th in population out of the nation’s 382 MSAs1. The Orlando MSA’s economy is expected to benefit from a growing population base and higher income and education levels. The Orlando MSA saw an increase in the number of jobs in the past ten years, and its employment growth is expected to continue. The Orlando MSA’s economy is expected to improve and employment will grow, strengthening the demand for real estate, including small bay industrial, overall.

Properties

Lakefront Business Park2

6101, 6149,6203 & 6251 Chancellor Dr

Lakefront Business Park offers garden-style office suites with large glass-paned windows and provides an abundant amount of natural lighting. The Property features rear-entry loading with grade-level rollup doors and suite clearance heights of 18’. The Property is minutes from I-4 West, S Orange Blossom Trail, and the greater Orlando area.

| Clear Heights | 18′ |

| Parking Spaces | 898 |

| Year Built | 1986 |

| Total Acres | 15.89 |

| Total Square Feet | 192,767 |

| Avg. Rent/SqFT | $17.23 |

| Occupancy | 83.2% |

| Avg. Lease Term | 3.34 Yrs |

1. Esri 2024. Compiled by JLL Valuation Services, LLC. 2. As of June 13, 2024.

BaySpace Belle4

1200-1270 Belle Avenue

Recently renovated between 2023-2024, the BaySpace Belle property features 13 small bay industrial buildings, including 13 Small Bay industrial buildings, including 135 Small Bay Units, across 10.24 acres and boasts of 14-foot to 19-foot clear heights. The Property is conveniently located near I-4 and US-92/Hwy 17/S 17, providing access to the greater Orlando area.

| Drive-In Doors | 77 |

| Parking Spaces | 314 |

| Years Renovated | 2023-2024 |

| Total Acres | 10.24 |

| Total Square Feet | 186,162 |

| Avg. Rent/SqFT | $10.24 |

| Occupancy | 87.7% |

| Avg. Lease Term | 2.01 YRS |

1. Esri 2024. Compiled by JLL Valuation Services, LLC. 2. Bureau of Labor Statistics. County employment is from the Quarterly Census of Employment & Wages, all other areas use the Current Employment Survey. Unemployment rates use the Current Population Survey. Data is not seasonally adjusted. 3. As of March 2024 4. As of June 13, 2024

Basis Industrial

Basis Industrial (“Basis”) is a privately held and vertically integrated real estate owner and operator with over 100 years of combined development, management and acquisition expertise.

Basis focuses on under-managed niche real estate asset classes, including self-storage and multi-tenant industrial warehousing throughout the United States. By focusing on these fragmented asset class verticals that benefit from non-discretionary demand drivers and underrepresented institutional ownership, They can create value through active day-to-day in-house asset management and aggregate economies of scale, leading to potential optimized portfolio and investment performance.

Key Growth Drivers:

Property Manager: BaySpace

BaySpace acts as Basis’ in-house Property and Asset Management division. BaySpace utilizes management expertise to improve the current tenant roster. Additionally, BaySpace migrates all tenant communications and interactions to an online platform – including leasing, rental payments, and leasing inquiries. Basis will use its construction and development expertise to improve acquired sites, enhancing the tenant experience and increasing in-place rents on current tenants.

Property Level Improvements

Experts in Real Estate

Real Estate Track Record1

1. Real estate assets as of 03/31/2025, inclusive of affiliates. Past performance is not indicative of future results. 2. Real estate assets acquired from January 1, 2012 to March 31, 2025, inclusive of affiliates.

EXPERTS IN REAL ESTATE

Management Team

Matthew McGraner

President

Matthew McGraner is a member of the investment committee for the Sponsor and serves in numerous roles across the NexPoint platform. With over ten years of real estate, private equity, and legal experience, his primary responsibilities are to lead the strategic direction and operations of the real estate platform at NexPoint. McGraner has led the acquisition and financing of approximately $18.4 billion of real estate investments.

Brian Mitts

Chief Financial Officer

Brian Mitts is a member of the investment committee for the Sponsor and serves in numerous roles across the NexPoint platform. Currently, Mitts leads NexPoint’s financial reporting and accounting teams and is integral in financing and capital allocation decisions. Mitts was also a co-founder of NREA, as well as NXRT and NexPoint Advisors, L.P., the parent of NREA. He has worked for NREA or one of its affiliates since 2007.

D.C. Sauter

General Counsel

D.C. Sauter is General Counsel for Real Estate for NexPoint Advisors, L.P. Prior to joining NexPoint, he was a partner with Wick Phillips Gould & Martin, LLP, where his practice focused on all aspects of commercial real estate, including acquisitions, dispositions, entitlements, construction, financing, and leasing of industrial, office, retail, hotel, and multifamily assets. In addition to transactional matters, Sauter has significant experience in complex commercial disputes, foreclosures, and workouts.

An investment in NexPoint Small Bay II DST is highly speculative, illiquid and involves substantial risk including the potential loss of your entire investment. The photos presented in this brochure are of the actual Properties that are part of the Offering.

There are substantial risks in any investment program. See “Risk Factors” on page 20 of the accompanying PPM for a discussion of the risks relevant to this Offering. Distributions are not guaranteed. Please review the entire PPM prior to investing. Reference is made to the PPM for a statement of risks and terms of the Offering. The information set forth herein is qualified in its entirety by the PPM. All prospective Purchasers must read the PPM and no person may invest without acknowledging receipt and complete review of the PPM.

- An investment in an Interest is highly speculative and involves substantial risks including, but not limited to:

- this is a “best-efforts” offering with no minimum raise or minimum escrow requirements;

- the lack of liquidity and/or public market for the Interests;

- the holding of a beneficial interest in the Parent Trust with no voting rights with respect to the management or operations of the Trusts or in connection with the sale of the Properties;

- risks associated with owning, financing, operating and leasing small bay properties, and real estate generally, in Florida, and more specifically the Tampa – St. Petersburg – Clearwater Metropolitan Statistical Area (the “Tampa MSA”) and the Orlando – Kissimmee – Sanford Metropolitan Statistical Area (the “Orlando MSA”);

- the Properties are located in a “Hurricane Susceptible Region,” which increases the risk of damage to the Properties;

- risks associated with small bay properties, such as occupancy rate or rent fluctuations, sensitivity to local economic activity and population shifts;

- risks associated with general market fluctuations such as recessions (global or local), the impact of pandemics (including the COVID-19 pandemic), and other systemic market or economic fluctuations of the communities in which the Properties exist;

- the Trusts depend on the Master Tenants for revenue, and the Master Tenants depend on the Tenants for revenue and thus any default by the Master Tenants or the Tenants will adversely affect the Trusts’ operations;

- performance of the Master Tenants under their respective Master Leases, including the potential for the Master Tenants to defer a portion of rent payable under such Master Leases;

- reliance on the Master Tenants and the Property Manager engaged by the Master Tenants, to manage each of the Properties;

- risks associated with the Sponsor (“NexPoint Real Estate Advisors IV, L.P.”) funding the Demand Notes (as defined herein) that capitalize each of the Master Tenants;

- risks relating to the terms of the financing for the Properties, including the use of leverage;

- the existence of various conflicts of interest among the Sponsor, the Trusts, the Master Tenants, the Asset Manager, the Property Manager, and their affiliates;

- material tax risks, including treatment of the Interests for purposes of Code Section 1031 and the use of exchange funds to pay acquisition costs, which may result in taxable boot;

- the lack of a public market for the Interests;

- the Interests not being registered with the Securities and Exchange Commission (the “SEC”) or any state securities commissions;

- risks relating to the costs of compliance with laws, rules and regulations applicable to the Properties;

lack of diversity of investment; - risks related to competition from properties similar to and near the Properties; and

- the possibility of environmental risks related to the Properties.

NexPoint Securities, Inc., an entity under common control with the Sponsor, serves as the Managing Broker-Dealer

of the Offering. The Managing Broker-Dealer was formed in November 2013 and is registered as a broker-dealer

with the SEC and is a member of FINRA/SIPC.

PLEASE CONTACT YOUR ADVISOR WITH ANY QUESTIONS ABOUT THIS OFFERING.