NexPoint Life Sciences III DST features a cGMP and research and development facility currently occupied by a contract development and manufacturing organization (CDMO) located in Woodybury, MN.

Quick Links

3rd Party Due Diligence Report

Coming Soon

Sign Selling Agreement via DocuSign

Request a Link to Sign Below

Offering Snapshot

This Offering features a state-of-the-art 137,811 square foot industrial property that was built-to-suit the global headquarters of the Tenant, Kindeva Drug Delivery L.P., a premier contract development and manufacturing organization (“CDMO”). NexPoint believes that the Property presents an attractive long-term investment opportunity due to strong industry tailwinds and a strong Tenant. The current good manufacturing practices (“cGMP”) and research and development (“R&D”) facility is fundamental to the Tenant’s business and offers a desirable triple net lease term.

Acquisition Details

Total Acquisition Cost1

$59,094,426

Total Capitalization

$61,961,253

Highlights of the Trust

Offering Size

$30,661,253

Minimum Purchase – Cash

$100,000

Minimum Purchase – 1031

$100,000

Suitability

Accredited Investors Only

Loan Information

Total Loan Amount

$31,300,000

Loan-To-Capitalization2

50.52%

Interest Rate3

4.50% Fixed Rate

Amortization

Interest Only through December 2025

Loan Term

9 Years

11. The Total Acquisition Cost includes the purchase price of the Property and Other Closing Costs. 2. The loan-to-capitalization ratio (“LTC”) is the ratio of a loan to the capitalization of an asset purchased. For instance, if someone borrows $80,000 to purchase a property worth $100,000, the LTC ratio is $80,000 to 100,000 or $80,000/100,00, or 80%. 3 Beginning on November 2029, the interest rate will be adjusted to equal 2.00%, plus the Three-Year US Treasury Constant. For example, if the Three-Year Treasury Constant yield is 4.25%, the interest rate will be 6.25%. The Three-Year Treasury Constant yield could be higher or lower affecting the interest rate. There are substantial risks in any investment program. See ‘‘ Risk Factors” on page 34 of the PPM for a discussion of the risks relevant to the Offering. Please review the entire PPM prior to investing. This material does not constitute an offer to sell. Reference is made to the PPM for a statement of risks and terms of the Offering. The information set forth herein is qualified in its entirety by the PPM. All potential Purchasers must read the PPM and no person may invest without acknowledging the receipt and complete review of the PPM.

LIFE SCIENCES SECTOR GROWTH

A Sector Driven by Strong Demand

The life sciences sector has experienced significant growth in recent years, driven by increased investment, technological advancements, the COVID-19 pandemic, and the aging population. These four factors below1 have contributed to the sector’s expanding role in addressing global health challenges, developing innovative therapies, and improving the quality of life for people around the world.

30%

In 2022, life sciences job postings grew 30% YoY in the U.S.1

2.1M

U.S. life sciences employment hit a record 2.1 million jobs at the start of 2023.2

50%

Life sciences laboratory inventory jumped by nearly 50% in five years.3

INCREASED INVESTMENT

The life sciences sector has experienced a surge in investment in recent years. According to a report by EY, global life sciences investment reached a record high of $357 million in 2020, up from 2019.4

TECHNOLOGICAL ADVANCEMENTS

The use of “big data” analytics, artificial intelligence, and machine learning has

revolutionized drug discovery and development, enabling researchers to identify potential treatments more quickly and accurately.

COVID-19 PANDEMIC

The COVID-19 pandemic highlighted the importance of the life sciences sector in addressing global health challenges. The sector plays a critical role in developing vaccines, diagnostic tests, and treatments, demonstrating its essential role in public health.

AGING POPULATION

The world’s population is aging, creating a growing demand for healthcare services and treatments for age-related diseases. The life sciences sector is uniquely positioned to address these challenges by developing innovative therapies and treatments.

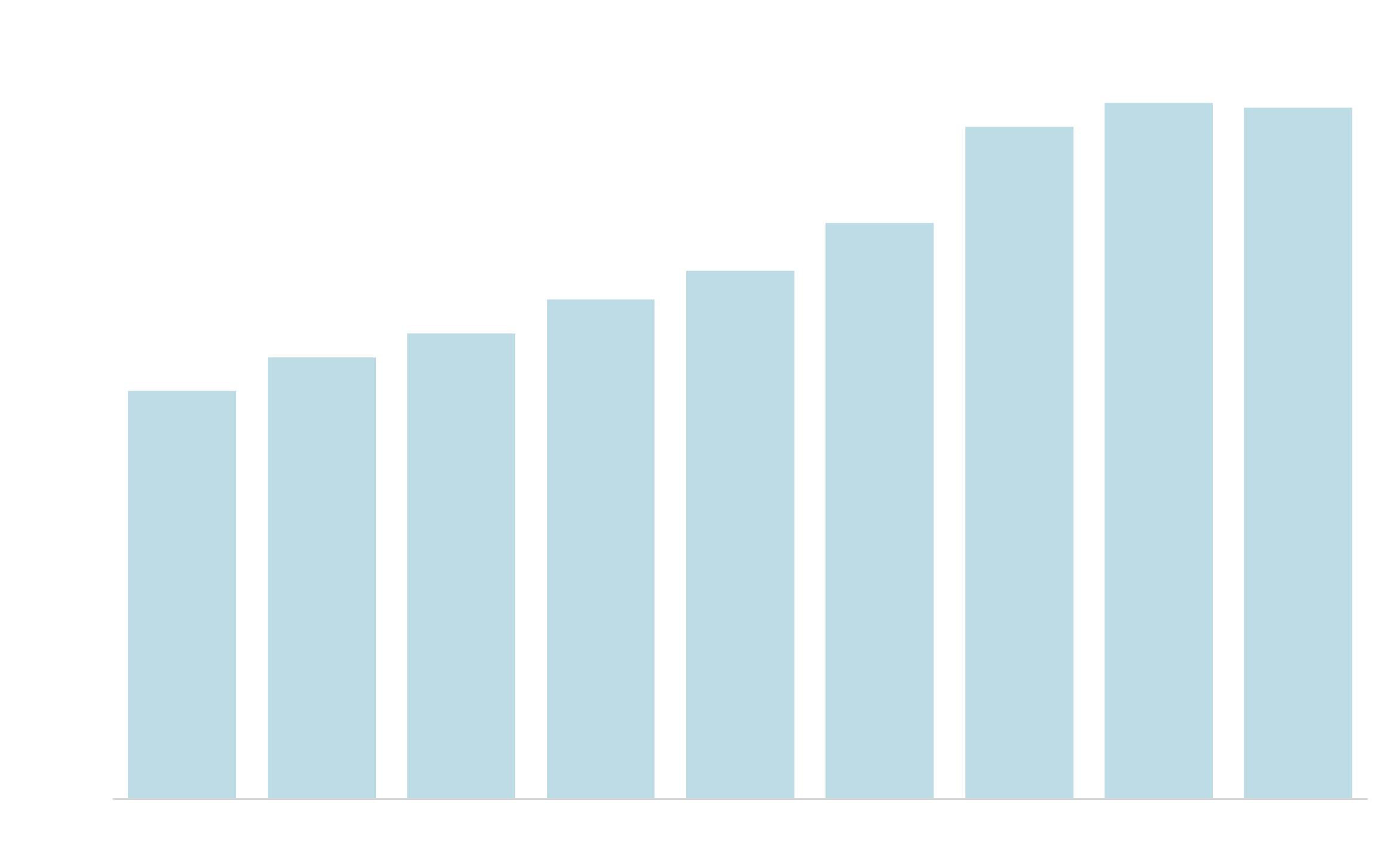

LIFE SCIENCES RESEARCH DEVELOPMENT & EXPENDITURES5

1Cushman Wakefield March 2023 Life Sciences Update. 2. CBRE Life Sciences Outlook 2023. 3. Axios April 2023 4. 2020 EY M&A Firepower Report 5. S&P Capital IQ, CBRE Research, February 2023

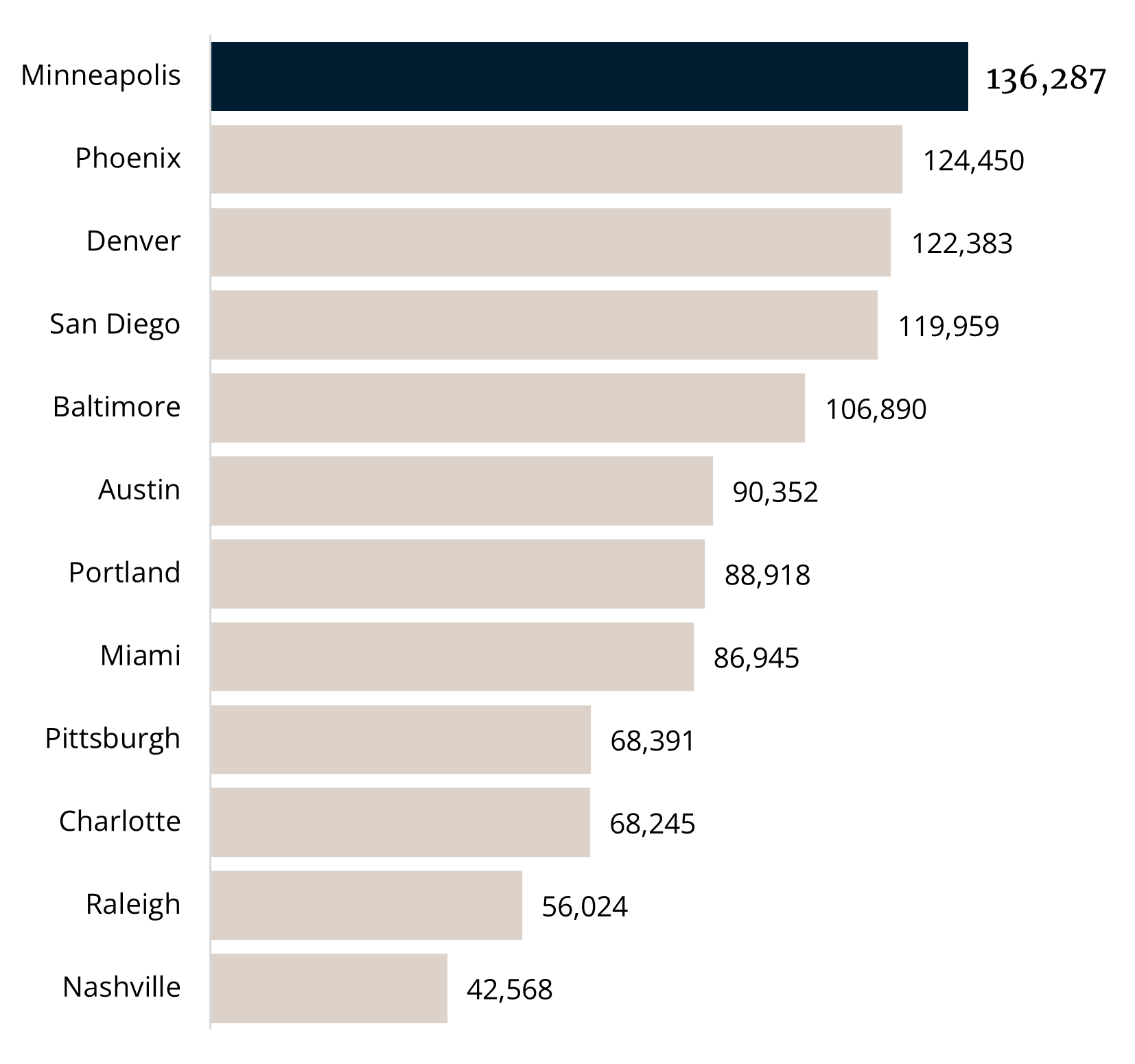

THE MINNEAPOLIS MSA

A Growing Hub for Life Sciences1

The Minneapolis MSA metropolitan statistical area (“MSA”) is a growing hub for life sciences. The Minneapolis MSA is home to the University of Minnesota, ranked ninth among public research universities, and the Mayo Clinic, a leading hospital in the United States. Overall, Minnesota’s employment in medical device manufacturing is four times more concentrated than the national average, leading the state to be a hub for research and development in the medical technology field. Additionally, the Minneapolis MSA is a top 10 MSA in the United States in total life science employment.1

THE MINNEAPOLIS MSA ACCOLADES1

#1

In the Midwest for Top Tech Talent

#14

Nationally Total Tech Workforce

#18

Nationally for Top Tech Talent

#18

Largest Industrial Tech Market

136k

Tech Employees in Minneapolis MSA

11. Jones Lang LaSalle Americas, Inc. ;June 2022

Prime Location

Woodbury, Minnesota

The Property is located in Woodbury, Minnesota, a city within the Minneapolis MSA, just 20 miles from downtown Minneapolis. The Minneapolis MSA has received over $6.7 billion of National Institutes of Health and venture capital funding since 2015, is home to 16 Fortune 500 firms, and boasts of a diverse and growing economy.6

3,693,729

2022 Total Population1

10.94%

2010-2021 Population Growth Rate1

$91,341

Median Household Income1

#9

Best Place to Live2

1.5%

Unemployment Rate3

2.9%

Employment Growth From 2021 to 20225

#3

Most Educated State2

#1

Job Market with 1.72 Ration of Jobs to Jobseekers4

1. U.S. Census Bureau (2022). American Community Survey 1-year estimates. Retrieved from Census Reported Profile page for Minneapolis-St. paul-Bloomington, MN. 2. U.S. News & World Report 3. Bureau of Labor Statistics 4. ZipRecruiter 5. Moody’s Analytics: Minneapolis-St.Paul-Bloomington; May 2022 6. Jones Lang LaSalle Americas,Inc; June 2022

11200 Hudson Road

Headquarters for Kindeva Drug Delivery L.P.

The Property included in this Offering is a mission critical facility for the Tenant, Kindeva Drug Delivery L.P., and is a Class-A industrial space constructed specifically for distribution, manufacturing (“cGMP”), and research and development. The Property is 137,811 square feet and sits on 11.7 acres of land. Located near Interstate 94, the Property is ideally situated between the Great Lakes and the northern Great Plains regions.

137,811

Square Feet

43,565

Square Feet of R&D and CGMP Space

2

Floors & Mezzanine Level

33-36'+

Clearance Height

250

Parking Spaces

2021

Year Built

The Tenant

Kindeva Drug Delivery

Kindeva is a CDMO that guides complex drug and delivery device development, from inception to commercial manufacturing. With a rich history dating back to 1946, Kindeva has handled 20+ drug master files, over 20 new drug applications, and 30+ abbreviated new drug applications. Kindeva has successfully navigated challenging projects like metered-dose inhalers and seven-day drug delivery patches through formulation, clinical trials, and regulatory approvals.

COMPANY TIMELINE

The Tenant

Fact Facts

~1,300

Patents

75

Inventions in Use

~100M

Commercial Devices Shipped Annually

9

Manufacturing and R&D Facilities1

100+

Years of Experience

~1M

Square Feet of cGMP Footprint1

2,000+

Total Employees

1. Kindeva Drug Delivery

THE TENANT

Contract Development and Manufacturing Organization (CDMO)

CDMO stands for contract development and manufacturing organization. A CDMO provides a wide range of services to the pharmaceutical and biotechnology industries, including drug development, manufacturing, and packaging.

A CMO helps pharmaceutical and biotech companies scale their manufacturing processes efficiently and perform an important function in the context of clinical trials and commercial product launches. By working with a CDMO, pharmaceutical and biotech companies can focus on their core competencies.

CDMO Process

Formulation Development

Optimization Scale-UP

Manufacturing

Packaging

Post-Manufacturing Support

Kindeva Facility Capabilities

Formulation

The formulation process involves assessing the drug delivery feasibility, rapidly screening and characterizing raw materials, using innovative particle engineering

techniques, assessing drug-device interactions, and refining the delivery system, which includes inhalation, transdermal, and microstructured transdermal systems.

Product Development

Product development includes focusing on finalizing product design and method validation, characterizing in vitro drug product performance, designing a clinical plan, leading and supporting pilot and pivotal clinical studies, and ultimately developing and submitting a registration application to regulatory authorities.

Scale-Up Manufacturing

In scale-up manufacturing, the primary tasks involve developing manufacturing processes at the required scale, providing support for clinical trials and regulatory data requirements, demonstrating process performance through validation, and effectively managing the supply chain, particularly in terms of sourcing active pharmaceutical ingredients (API) and components.

Commercial Manufacturing

Commercial manufacturing involves implementing a product’s control strategy, establishing a quality agreement with the client, ensuring ongoing process performance, maintaining compliance with evolving regulatory standards, managing the supply chain for sourcing API components, and packaging materials.

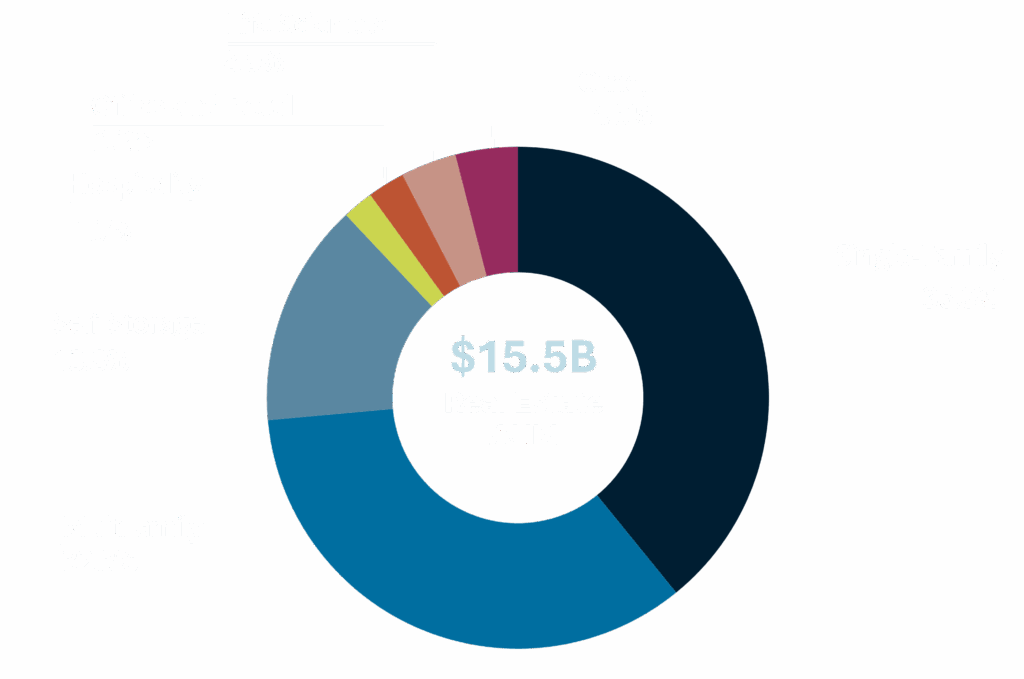

Experts in Real Estate

Real Estate Track Record1

1. Real estate assets as of 03/31/2025, inclusive of affiliates. Past performance is not indicative of future results. 2. Real estate assets acquired from January 1, 2012 to March 31, 2025, inclusive of affiliates.

Experts in Real Estate

Management Team

Matthew McGraner

Chief Investment Officer

Matthew McGraner is a member of the investment committee for the Sponsor and serves in numerous roles across the NexPoint platform. With over ten years of real estate, private equity, and legal experience, his primary responsibilities are to lead the strategic direction and operations of the real estate platform at NexPoint. McGraner has led the acquisition and financing of approximately $18.4 billion of real estate investments.

Brian Mitts

Chief Financial Officer

Brian Mitts is a member of the investment committee for the Sponsor and serves in numerous roles across the NexPoint platform. Currently, Mitts leads NexPoint’s financial reporting and accounting teams and is integral in financing and capital allocation decisions. Mitts was also a co-founder of NREA, as well as NXRT and NexPoint Advisors, L.P., the parent of NREA. He has worked for NREA or one of its affiliates since 2007.

Paul Richards

Director, Real Estate

Paul Richards is a director for real estate at NexPoint. His primary responsibilities are to research and conduct due diligence on new investment ideas, perform valuation and benchmarking analysis, monitor and manage investments in the existing real estate portfolio, and provide industry support for NexPoint’s Real Estate Team. He was previously a Product Strategy Associate and was responsible for evaluating and optimizing the registered product lineup.

Taylor Colbert

Director, Real Estate

Taylor Colbert is a director for real estate at NexPoint. He conducts due diligence and research on new investment ideas, performs valuation and benchmarking analysis, and manages investments in the existing real estate portfolio, providing support for NexPoint’s real estate team. Before joining NexPoint, he was an associate in private equity and senior fund analyst with a former NexPoint affiliate. Prior to this, he was employed by KPMG LLP as a senior audit associate in the Alternative Investment Group. He is a licensed CPA and a CFA charterholder.

For Due Diligence Use Only

An investment in NexPoint Life Sciences III DST is highly speculative, illiquid and involves substantial risk including the potential loss of your entire investment. The photos presented in this brochure are of the actual Properties that are part of the Offering.

There are substantial risks in any investment program. See “Risk Factors” on page 34 of the accompanying PPM for a discussion of the risks relevant to this Offering. Distributions are not guaranteed. Please review the entire PPM prior to investing. Reference is made to the PPM for a statement of risks and terms of the Offering. The information set forth herein is qualified in its entirety by the PPM. All prospective Purchasers must read the PPM and no person may invest without acknowledging receipt and complete review of the PPM.

An investment in an Interest is highly speculative and involves substantial risks including, but not limited to:

- this is a “best-efforts” offering with no minimum raise or minimum escrow requirements;

- the lack of liquidity and/or public market for the Interests;

- the holding of a beneficial interest in the Trust with no voting rights with respect to the management or operations of the Trust or in connection with the sale of the Property;

- risks associated with owning, financing, operating and leasing a medical device research and development facility, and real estate generally, in Minnesota, and more specifically the Minneapolis MSA;

- the Tenant is engaged in the business of medical device research and development which is a highly competitive business characterized by rapidly evolving technology and thus the Tenant’s financial instability will materially and adversely affect the Master Tenant’s and the Trust’s operations;

- risks associated with the impact of pandemics, including the COVID-19 pandemic, on the Property and the economies of the community in which the Property exists;

- under the Tenant Lease, the Tenant is allowed to make certain permitted alterations to the Property which could adversely affect the Master Tenant’s ability to re-tenant the Property to a new tenant;

- the Property is highly specific to the Tenant’s medical device research and development operations, which may adversely affect the Master Tenant’s ability to re-tenant the Property;

- the Trust depends on the Master Tenant for revenue, and the Master Tenant depends on the Tenant for revenue and thus any default by the Master Tenant or the Tenant will adversely affect the Trust’s operations;

- performance of the Master Tenant under the Master Lease;

- reliance on the Master Tenant to manage the Property;

- risks associated with the Master Tenant’s finances, including its limited capital, limited operating history, and the Demand Note that capitalizes the Master Tenant;

- risks relating to the terms of the financing for the Property, including the use of leverage;

- the existence of various conflicts of interest among the Sponsor (“NexPoint Real Estate Advisors IV L.P”) the Trust, the Master Tenant, the Asset Manager, and their affiliates;

material tax risks, including treatment of the Interests for purposes of Code Section 1031 and the use of exchange funds to pay acquisition costs, which may result in taxable boot; - the Interests not being registered with the SEC or any state securities commissions;

risks relating to the costs of compliance with laws, rules and regulations applicable to the Property; - risks related to competition from properties similar to and near the Property; and

- lack of diversity of investment as to type of asset or geographic location.

NexPoint Securities, Inc., an entity under common control with the Sponsor, serves as the Managing Broker-Dealer of the Offering.

The Managing Broker-Dealer was formed in November 2013 and is registered as a broker-dealer with the SEC and is a member of FINRA/SIPC.

PLEASE CONTACT YOUR ADVISOR WITH ANY QUESTIONS ABOUT THIS OFFERING.