Biomanufacturing

Life Sciences DST

NexPoint Life Sciences DST offers an opportunity to invest in a high-quality, well-located property with a long-term lease structure in an industry with high demand.

Due Diligence Resources

Offering Documents and Materials

3rd Party Due Diligence Report Coming Soon

Offering Snapshot

The property is strategically located one hour from New York City and houses all of the Tenant’s manufacturing and employees. The Tenant’s lease structure provides for a compelling passive investment opportunity, supported by a 20-year initial term, contractual rental escalation every year, and triple net structure with the Tenant responsible for property tax, insurance, maintenance and repair.

Acquisition Details

| Total Acquisition Cost1 | $163,369,074 |

| Supplemental Reserves | $450,000 |

| Reserves2 | $3,782,563 |

| Total Capitalization | $177,550,012 |

Highlights of the Trust

| Offering Size | $107,550,012 |

| Minimum Purchase -Cash | $100,000 |

| Minimum Purchase -1031 | $100,000 |

| Suitability | Accredited Investor Only |

Loan Information

| Loan Amount | $70,000,000 |

| Leverage to Investors | 39.43% |

| Interest Rate3 | 4.95% Fixed Rate |

| Loan Term3 | 10 Years |

| Amortization3 | 5 Years Interest Only |

1 Includes the Purchase Price, transactional closing costs, fees and financing closing costs; 2 Reserves refers to the Working Capital Reserve, Transfer Tax Reserve and Interest Reserve; 3 If the Tenant, a replacement tenant under the Tenant Lease, or any guarantor of the Tenant’s obligation under the Tenant Lease has: (1) a common equity market capitalization on a nationally recognized stock exchange of $5 billion or higher, or (2) a minimum long term unsecured debt rating of at least “A” by Standard and Poor and “A2” by Moody’s, the fixed interest rate will be reduced to 4.50% per annum and the Loan will become full-term interest-only. If at any point in the future the Tenant, a replacement tenant under the Tenant Lease, or any guarantor of the Tenant’s obligation under the Tenant Lease fails to meet the foregoing requirements, the Loan will revert back to a fixed interest rate of 4.95% and interest-only for the first 60 months. There are substantial risks in any investment program. See “Risk Factors” on page 18 of the accompanying PPM for a discussion of the risks relevant to the Offering. Distributions are not guaranteed.

Please review the entire PPM prior to investing. This material does not constitute an offer to sell and is authorized for use only when accompanied or preceded by the PPM. Reference is made to the PPM for a statement of risks and terms of the Offering. The information set forth herein is qualified in its entirety by the PPM. All potential Purchasers must read the PPM and no person may invest without acknowledging the receipt and complete review of the PPM.

BIOMANUFACTURING

Characteristics of Biomanufacturing Facilities

Low and Wide Profile in

Flexible Zoning Districts

Taller Ceilings: 13-15 Ft

Interior Clear Heights

Electrical and Critical

System Redundancy to

Protect Facility from Power Outages

Internal Truck and

Freight Access for Labs

with Material/Input

Requirements

Unique HVAC and Ventilation in Adherence with Equipment

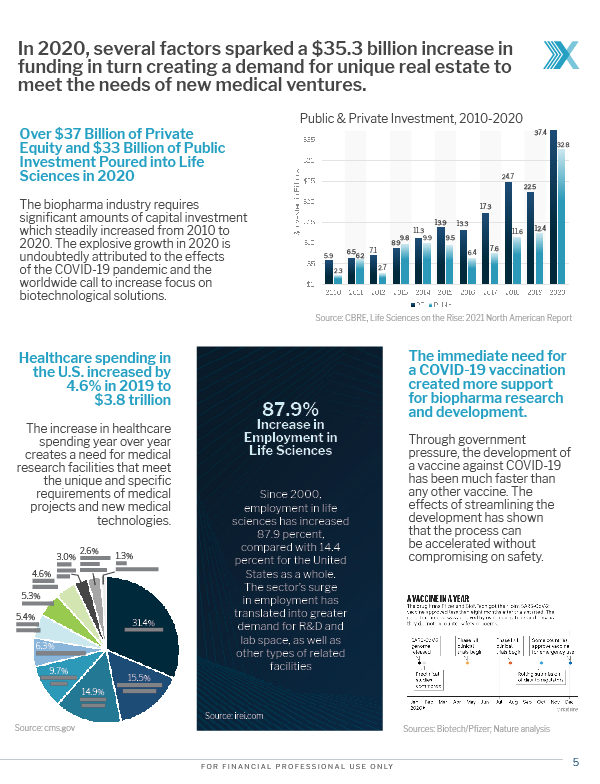

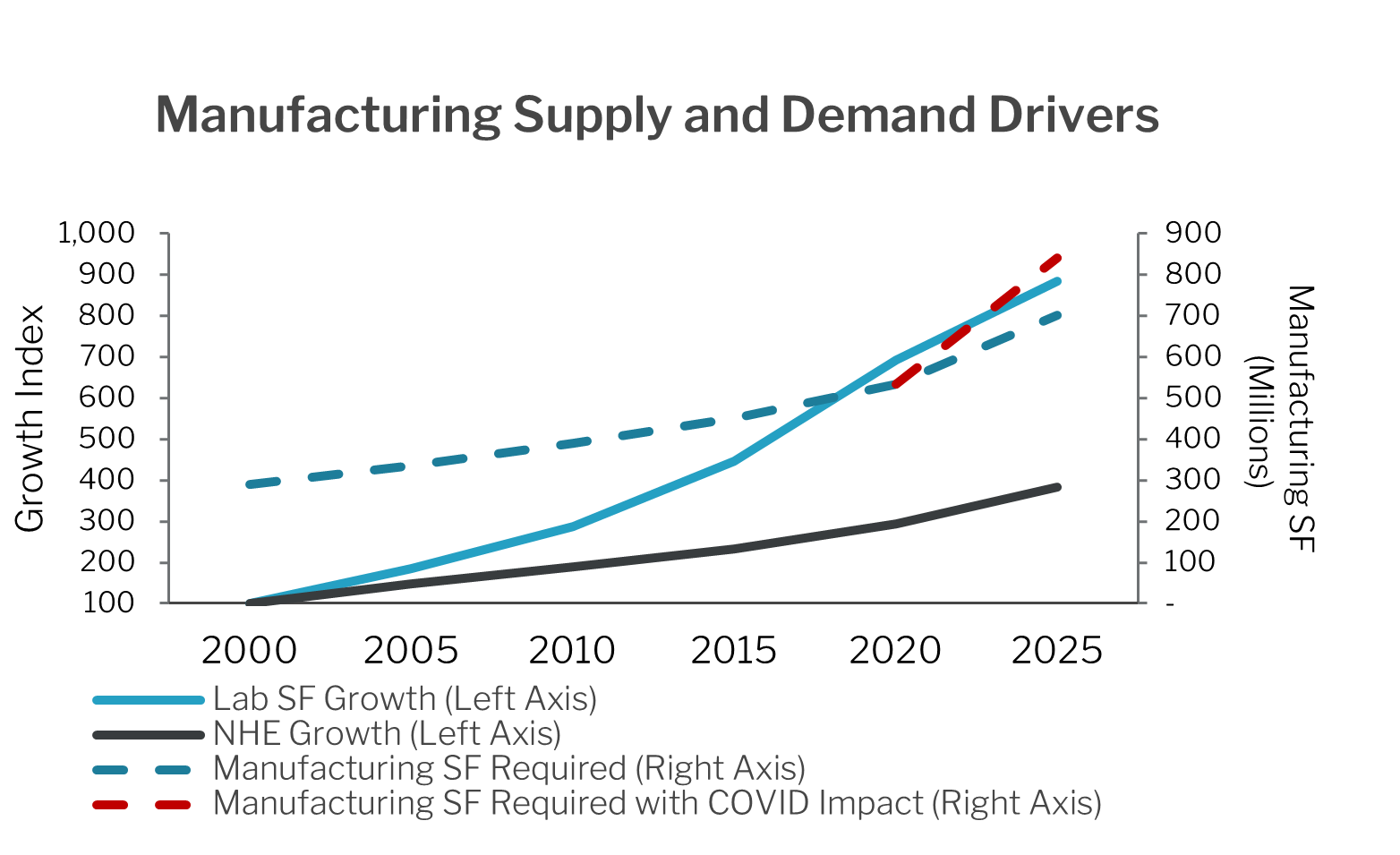

In 2020, several factors sparked a $35.3 billion increase in funding, creating a demand for unique real estate to meet the needs of new medical ventures

Source: CBRE Research. Q3 2020

Over $37 Billion of Private Equity and $33 Billion of Public Investment Poured into Life Sciences in 2020

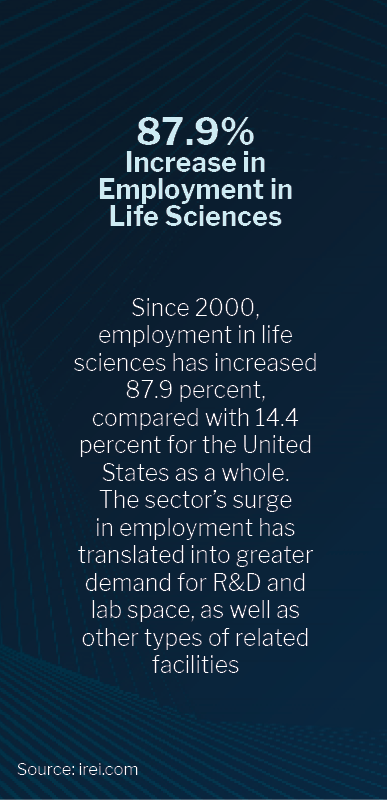

The biopharma industry requires significant amounts of capital investment which steadily increased from 2010 to 2020. The explosive growth in 2020 is undoubtedly attributed to the effects of the COVID-19 pandemic and the worldwide call to increase focus on biotechnological solutions.

Public & Private Investment, 2010-2020

Source: CBRE, Life Sciences on the Rise: 2021 North American Report

Life Science Sector Today

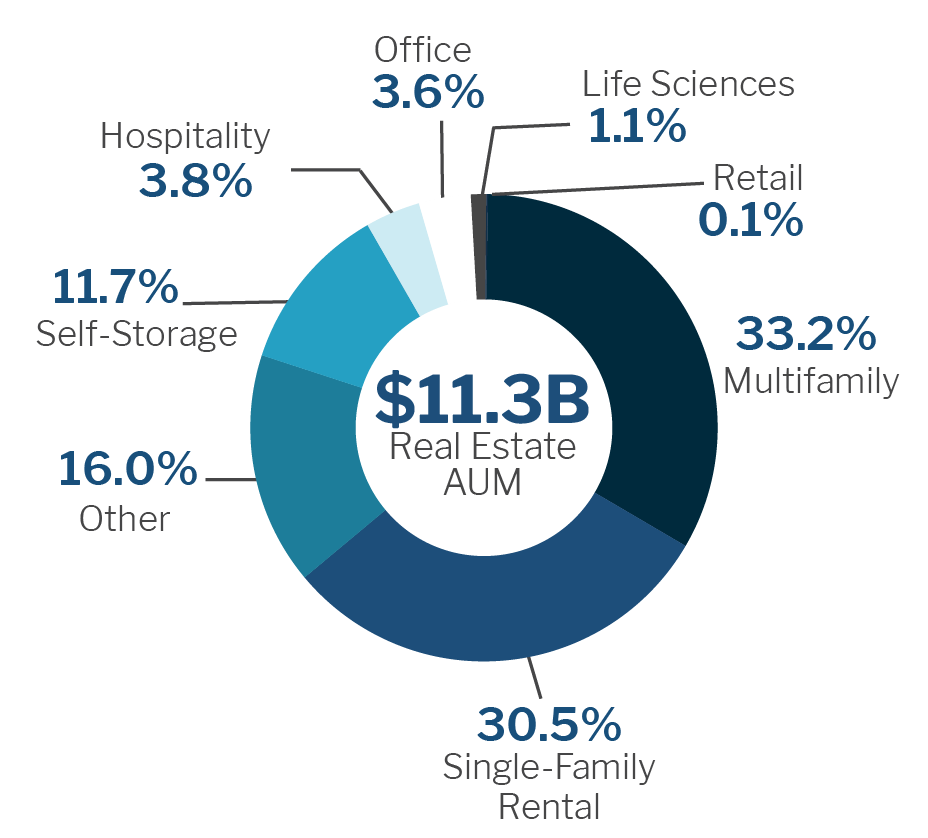

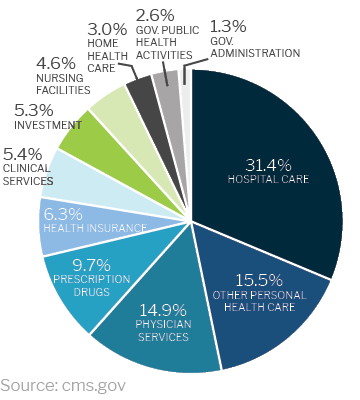

Healthcare spending in the U.S. increased by 4.6% in 2019 to $3.8 trillion

The increase in healthcare spending year over year creates a need for medical research facilities that meet the unique and specific requirements of medical projects and new medical technologies.

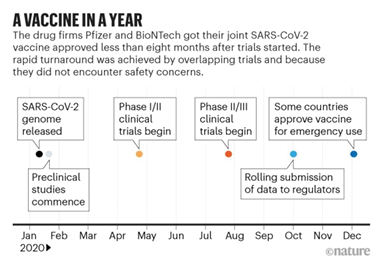

The immediate need for a COVID-19 vaccination created more support for biopharma research and development.

Through government pressure, the development of a vaccine against COVID-19 has been much faster than any other vaccine. The effects of streamlining the development has shown that the process can be accelerated without compromising on safety.

Source: Biotech/Pfizer; Nature analysis

The Property

The Property is a purpose-built life science real estate asset, specifically designed and maintained to support FDA approved products, drugs and therapies.

Research, Development, Formulation and Manufacturing

The Property is cGMP compliant and FDA validated. The Tenant regularly inspects, maintains and invests in the upkeep of the facility to continue the uninterrupted manufacture of its products. The Property houses all of The Tenant’s manufacturing and employees. It is expected to serve as the manufacturing location for its latest product development in partnership with approximately $9 billion dollar equity market cap capitalization pharma company.

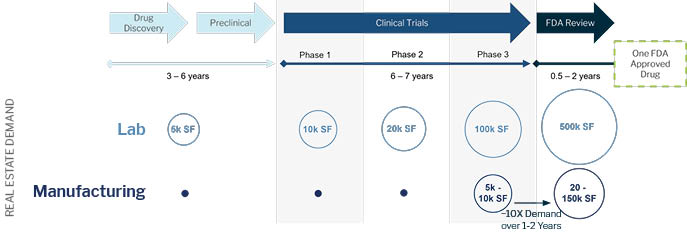

The Life Science Industry Provides Clear Demand Visibility Over the Drug

Development Timeline

Life science space is essentially full on a national level due to the demand driven by re-onshoring and new biologics. Globally, the pharma industry generates approximately $1.5 trillion dollars in revenue per year and is expected to grow even larger. The forecasted demand for space is three to five times the existing available space in the industry.

The Property is strategically located near leading scientific institutions and other major life science companies.

Use of the Property is fundamental to the Tenant’s business, housing all the Tenant’s manufacturing and production of Afrezza.

The Property is fundamental to the Tenant’s business, housing all the Tenant’s manufacturing and production of Afrezza. The Property is strategically located one hour from New York City and is proximate to leading universities, scientific institutions, and other major life science users such as:

Regeneron: $53 billion equity market capitalization, using ~750K sqft

Pfizer: $210 billion equity market capitalization, using ~4.5 million sqft in 2 nearby states

Boehringer Ingelheim: $19 billion sales (largest pharmaceutical company in the world), using ~350K sqft

IQVIA Holdings: publicly traded CDMO with $35 billion market capitalization and executive headquarters in Danbury, CT

The Tenant, MannKind

The Sponsor believes MannKind Corporation (NASDAQ: MNKD, “MannKind”) is a Quality Life Science Tenant

MannKind has demonstrated access to capital with strong analyst support, a robust drug pipeline and established strategic partnerships.

MannKind is exclusively responsible for manufacturing clinical and commercial supplies of Treprostinil Technosphere (TreT) at the Danbury facility and United Therapeutics has agreed to invest $20-30 mm improving the warm shell space in advance of commercial launch.

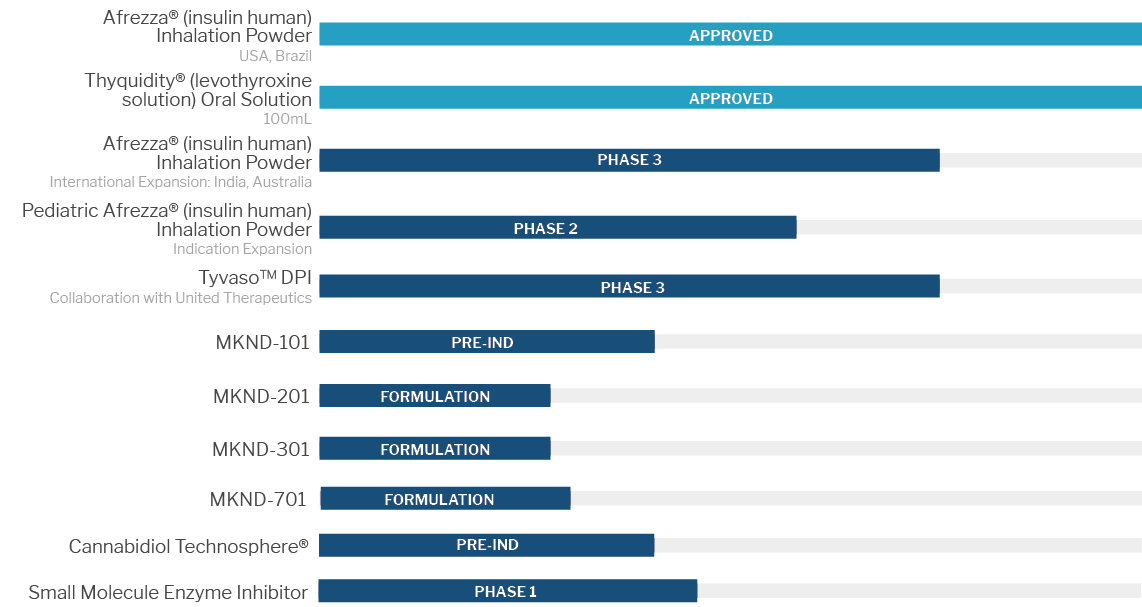

The MannKind Pipeline has Two FDA Approved Drugs and More in Development

Technosphere® Technology an innovative, dry-powder formulation technology that allows medication to be delivered through the lungs, can be applied to a number of therapeutic areas that are both in high-demand for innovation, and in need for a different kind of treatment option for people living with these conditions.

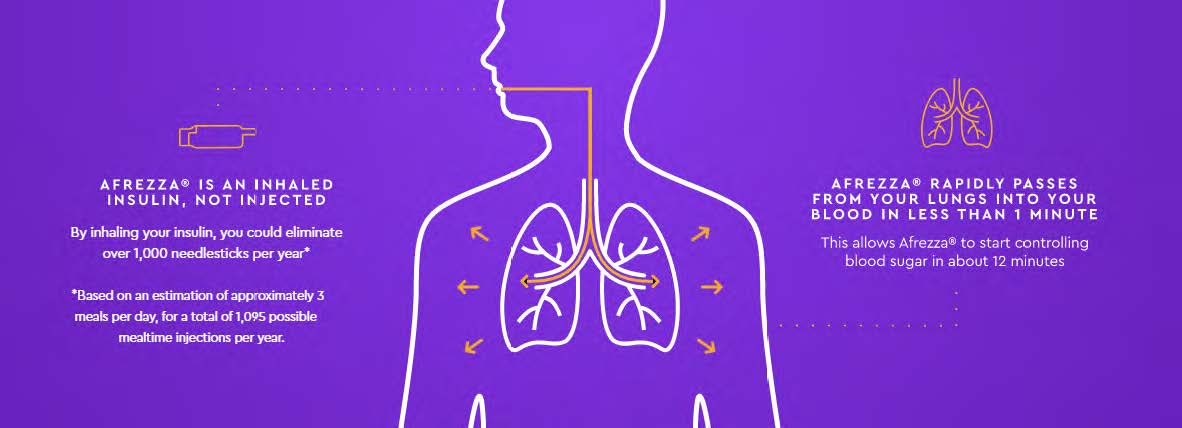

Meet Afrezza®, the only ultra rapid-acting insulin that delivers glucose management in the moment, MannKind’s FDA-approved drug.

Afrezza® is a dry insulin powder drawn in through the lungs via an oral inhaler that controls high blood sugar in adults with type 1 or type 2 diabetes. No more mealtime injections. Now you can inhale insulin right when your food arrives, giving you the flexibility and control you’ve always wanted. Afrezza® has proven mealtime control in studies of more than 3,000 people with either type 1 or type 2 diabetes.

Latest News and Press

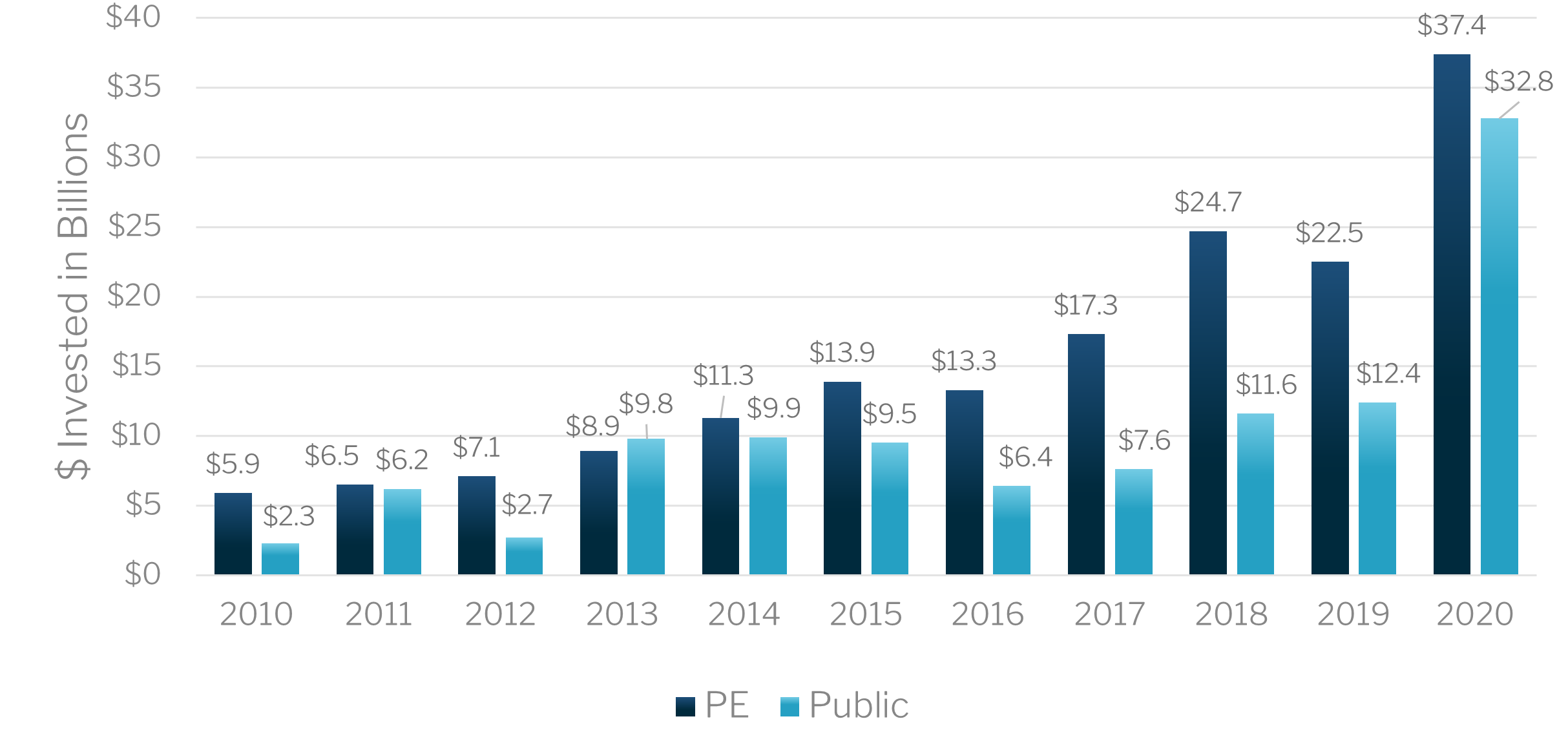

EXPERTS IN REAL ESTATE1

NexPoint Real Estate Track Record

$14.1 Billion

In Gross Real Estate Acquisitions2

$3.3 Billion

In Real Estate Transactions in the Last 12 Months2

279

Real Estate Acquisitions2

32

States Nationwide

1Real estate assets as of September 30, 2021, inclusive of affiliates. 2Real estate assets acquired from January 1, 2012 to September 30, 2021, inclusive of affiliates. Gross IRR represents realized investments in real estate that NexPoint and affiliates no longer own. If fees and charges had been reflected, then this figure would have been lower. Please reference the NexPoint Track Record included in this material, or visit https://nexpoint.wpenginepowered.com/wp-content/uploads/2021/11/NREA-Track-Record-Piece.pdf.

EXPERTS IN REAL ESTATE

NexPoint DST Management Team

Brian Mitts

Chief Financial Officer

Mr. Mitts is a member of the investment committee for the Sponsor and serves in numerous roles across the NexPoint platform. Currently, Mr. Mitts leads NexPoint’s financial reporting and accounting teams and is integral in financing and capital allocation decisions. Mr. Mitts was also a co-founder of NREA, as well as NXRT and NexPoint Advisors, L.P., the parent of NREA. He has worked for NREA or one of its affiliates since 2007.

Matt McGraner

President

Mr. McGraner is a member of the investment committee for the Sponsor and serves in numerous roles across the NexPoint platform. With over ten years of real estate, private equity and legal experience, his primary responsibilities are to lead the strategic direction and operations of the real estate platform at NexPoint. acquisitions. Mr. McGraner has led the acquisition and financing of approximately $11.2 billion of real estate investments.

Matthew Goetz

Director, Real Estate

Mr. Goetz serves in numerous roles across the NexPoint platform. He has served as Senior VP-Investments and Asset Management of NexPoint Real Estate Finance (NYSE: NREF), as Senior VP-Investments and Asset Management of NexPoint Residential Trust (NYSE: NXRT) and is also a Director at NexPoint Real Estate Advisors and portfolio manager for NexPoint Real Estate Strategies Fund.

An investment in an Interest is highly speculative, illiquid and involves substantial risk including the potential loss of your entire

investment.

There are substantial risks in any investment program. See “Risk Factors” on page 18 of the accompanying PPM for a discussion of the risks relevant to this Offering. Distributions are not guaranteed. The forecasted distribution rates are only estimates based on the specific assumptions more fully described in the PPM. There is no guarantee that the assumptions used in the projections will be actualized. Please review the entire PPM prior to investing. This material does not constitute an offer to sell and is authorized for use only when accompanied or preceded by the PPM. Reference is made to the PPM for a statement of risks and terms of the Offering. The information set forth herein is qualified in its entirety by the PPM. All potential investors must read the PPM and no person may invest without acknowledging receipt and complete review of the PPM.

An investment in an Interest is highly speculative and involves substantial risks including, but not limited to:

• this is a “best-efforts” offering with no minimum raise or minimum escrow requirements;

• the lack of liquidity and/or a public market of the Interests;

• the holding of a beneficial interest in the Trust with no voting rights with respect to the management or operations of the Trust or in connection with the sale of the Property

• risks associated with owning, financing, operating and leasing a pharmaceutical manufacturing facility and real estate generally in the Bridgeport–Stamford–Norwalk–Danbury MSA metropolitan statistical area (the “Danbury MSA”);

• the Property is located in a “Hurricane Susceptible Region,” which increases the risk of damage to the Property;

• risks associated with the impact of pandemics, including the COVID-19 pandemic, on the Property, the Tenant, and the economy in which the Property exists;

• the Trust depends on the Master Tenant as its sole source for revenue, and the Master Tenant depends on the Tenant as its sole source for revenue and thus any default by the Master Tenant or the Tenant will adversely affect the Trust’s operations;

• the Tenant is engaged in the business of pharmaceutical manufacturing which is a highly competitive business characterized by rapidly evolving technology and thus the Tenant’s failure to achieve commercial success will materially and adversely affect the Master Tenant’s and the Trust’s operations;

• performance of the Master Tenant under the Master Lease, including the potential for the Master Tenant to defer a portion of rent payable under the Master Lease;

• under the Tenant Lease, the Tenant is allowed to make certain permitted alterations to the Property which could adversely affect the Master Tenant’s ability to re-tenant the Property to a new tenant;

• reliance on the Master Tenant and the Property Manager (defined below) engaged by the Master Tenant to manage the Property;

• the Tenant has a limited Repurchase Option with respect to the Property only exercisable on each of the Repurchase Dates, thus limiting the Manager’s control over timing the sale of the Property;

• the Beneficial Owners will not have any right to participate in the decision to sell the Property;

• risks associated with the Sponsor funding the Demand Note (defined below) that capitalizes the Master Tenant;

• lack of diversity of investment;

• the existence of various conflicts of interest among the Sponsor, the Trust, the Master Tenant, the Property Manager, and their affiliates;

• material tax risks, including treatment of the Interests for purposes of Code Section 1031, treatment of the MannKind Sale-Leaseback for federal income tax purposes, and the use of exchange funds to pay acquisition costs, which may result in taxable boot;

• the Interests not being registered with the Securities and Exchange Commission (the “SEC”) or any state securities commissions;

• risks relating to the terms of the financing for the Property, including the use of leverage;

• risks relating to the costs of compliance with laws, rules and regulations applicable to the Property;

• risks related to competition from properties similar to and near the Property; and

• the possibility of environmental risks related to the Property.

NexPoint Securities, Inc., an entity under common control with the Sponsor, serves as the Managing Broker-Dealer of the offering.

The Managing Broker-Dealer was formed in November 2013 and is registered as a broker-dealer with the Securities and Exchange Commission and is a member of FINRA/SIPC.