Offering Snapshot

Life Sciences II DST

NexPoint Life Sciences II DST features a portfolio of two life sciences assets located in Philadelphia, PA, an emerging submarket in the life sciences space

3rd Party Due Diligence Report

Coming Soon

Sign Selling Agreement via DocuSign

Request a Link to Sign Below

Marketing Materials

Offering Snapshot

This Offering features a portfolio of two life sciences assets located in Philadelphia, PA, an emerging submarket in the life sciences space. The Tenant, a leading technology-driven drug developer and manufacturer, has expanded to the Philadelphia MSA to take advantage of its its strong academic and research institutions, healthcare ecosystem, and supportive business environment.

Acquisition Details

| Total Acquisition Cost1 | $59,703,909 |

| Lender Reserves2 | $800,000 |

| Total Capitalization | $63,479,695 |

Highlights of the Trust

| Offering Size | $40,489,695 |

| Minimum Purchase -Cash | $100,000 |

| Minimum Purchase -1031 | $100,000 |

| Suitability | Accredited Investor Only |

Loan Information

| Total Loan Amount | $23,000,000 |

| Loan-To-Capitalization | 36.2% |

| Interest Rate | 6.16% Fixed Rate |

| Loan Term | 10 Years |

| Amortization | Interest Only |

1Includes the Contributor’s share of the Interests, all estimated costs and expenses related to the Offering, marketing, and transferring of the Interests, the amount of the Lender Reserves, Philadelphia Transfer Tax Reserve, and the payment of the Facilitation Fee. 2 Lender Reserves refers to the Rollover Reserve of $600,000 and the Replacement Reserve of $200,000.

Please review the entire PPM prior to investing. This material does not constitute an offer to sell. Reference is made to the PPM for a statement of risks and terms of the Offering. The information set forth herein is qualified in its entirety by the PPM. All potential Purchasers must read the PPM and no person may invest without acknowledging the receipt and complete review of the PPM.

Life Sciences Sector Growth

The life sciences sector has experienced significant growth in recent years, driven by increased investment, technological advancements, the COVID-19 pandemic, and the aging population. These four factors below1 have contributed to the sector’s expanding role in addressing global health challenges, developing innovative therapies, and improving the quality of life for people around the world.

INCREASED INVESTMENT

The life sciences sector has experienced a surge in investment in recent years. According to a report by EY, global life sciences investment reached a record high of $357 billion in 2020, up 18% from 2019.

TECHNOLOGICAL ADVANCEMENTS

The use of “big data” analytics, artificial intelligence, and machine learning has revolutionized drug discovery and development, enabling researchers to identify potential treatments more quickly and accurately.

COVID-19 PANDEMIC

The COVID-19 pandemic highlighted the importance of the life sciences sector in addressing global health challenges. The sector plays a critical role in developing vaccines, diagnostic tests, and treatments, demonstrating its essential role in public health.

AGING POPULATION

The world’s population is aging, creating a growing demand for healthcare services and treatments for age-related diseases. The life sciences sector is uniquely positioned to address these challenges by developing innovative therapies and treatments.

1 Cushman Wakefield March 2023 Life Sciences Update. 2 CBRE Life Sciences Outlook 2023 3 Axios April 2023

Philadelphia in Life Sciences

The Philadelphia MSA, which includes the city itself and its surrounding suburbs, boasts a robust life sciences ecosystem that encompasses pharmaceuticals, biotechnology, medical devices, diagnostics, and research and development. This dynamic industry cluster has been instrumental in driving the growth of life sciences real estate in the area.

PRESTIGOUS ACADEMIC INSTITUTIONS

Philadelphia is home to University of Pennsylvania, Drexel University, and Temple University, among others, which are at the forefront of cutting-edge research and development in life sciences.2 These institutions foster collaboration between academia, industry, and government, creating a conducive environment for innovation and driving demand for specialized real estate.

STRONG HEALTHCARE ECOSYSTEM

Philadelphia boasts world-class hospitals, medical centers, and research institutions within the state and tri state area of of Pennsylvania, New Jersey, and Delaware. These institutions provide a robust demand for life sciences real estate, ranging from research and development facilities to specialized lab spaces and manufacturing facilities for pharmaceuticals and medical devices.

SUPPORTIVE BUSINESS ENVIRONMENT

The supportive business environment in Philadelphia, with favorable tax incentives, grants, and funding opportunities, has encouraged life sciences companies to establish their presence in the area.2 The City of Philadelphia and the state of Pennsylvania have implemented various initiatives to support the growth of the industry, including the Keystone Innovation Zone program, the Research and Development Tax Credit, and the Ben Franklin Technology Partners program, among others.

1 Cushman Wakefield March 2023 Life Sciences Update, Philadelphia, PA. 2 Cushman Wakefield October 2022

The Properties

NexPoint Life Sciences II DST consists of two properties: the Orthodox Property and the Dungan Property.

Products Manufactured

Allopurinol, Amitriptyline, Amphetamine, Bactrim, Bisoprolol, Carvedilol, Chlorthalidone, Clonidine, Cyclobenzaprine, Deferasirox, Diclofenac Sodium, Ergoloid, Fenofibrate, Methylprednisolone, Minoxidil, Nystatin, Oxazepam, Phentermine, Qualaquin, Quinidine, Quinine, Spiro, Spironolactone, Sulf, Sulindac, Vigadrone

THE ORTHODOX PROPERTY

The Orthodox Property sits on 6.67 acres and offers three receiving bays, one loading bay, manufacturing capacity for three billion tablets and capsules annually, a high-potency manufacturing suite, 12 commercial tablet presses and five capsule fillers, two analytical labs housing over 100 instruments, and a controlled drug storage cage.

THE DUNGAN PROPERTY

The Dungan Property sits on 11.83 acres and offers six receiving bays, one drive-up loading bay, four commercial packaging lines, one powder filling line, packaging capacity for approximately four billion tablets and capsules annually, a temperature controlled warehouse, and a controlled drug storage cage.

Adare Pharma Solutions

Adare is a global technology-driven CDMO, with extensive capabilities across commercial manufacturing and packaging including oral solid dose and early-stage technology for injectables.

Adare is committed to helping its customers bring new products to market quickly and efficiently and is a leading partner to 100+ pharmaceutical companies across a variety of stages. 35% of Adare’s revenue is derived from investment-grade customers and Adare is backed by two premier private equity firms: Thomas H. Lee Partners and Frazier Healthcare Partners. Adare’s focus on technology and innovation, along with its deep expertise in drug development and manufacturing, makes it a trusted partner for pharmaceutical and biotech companies looking to bring new products to market.

45

Products

Adare has a portfolio of over 45 products sold in 100+ countries globally with experience in developing and manufacturing products for a variety of therapeutic areas, including cardiovascular, gastrointestinal, central nervous system, and respiratory diseases.

7

Facilities Worldwide

Adare has seven facilities in the US and Europe, and its team of 800+ employees includes scientists, engineers, and regulatory affairs specialists. Adare’s Philadelphia properties, including the Properties, provide a full range of solid-dose contract packaging services at both clinical and commercial scale.

Key Growth Drivers:

Experts in Real Estate

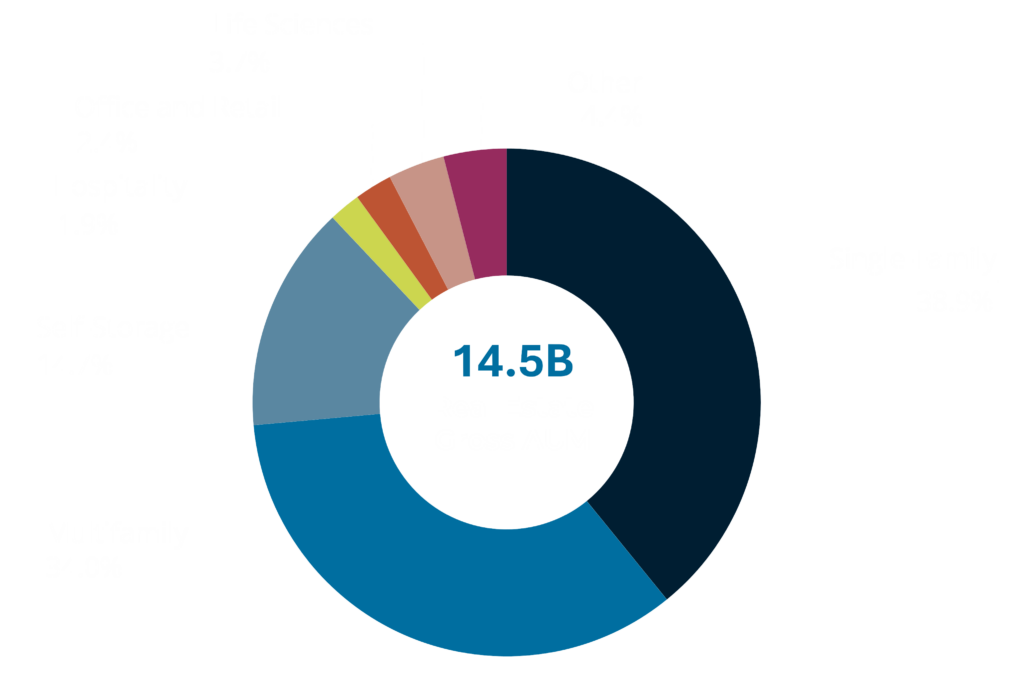

Real Estate Track Record1

1. Real estate assets as of 12/31/2024, inclusive of affiliates. 2. Real estate assets acquired from January 1, 2012 to December 31, 2024, inclusive of affiliates.

EXPERTS IN REAL ESTATE

The Sponsor’s Management Team

Matthew McGraner

President

Matthew McGraner is a member of the investment committee for the Sponsor and serves in numerous roles across the NexPoint platform. With over ten years of real estate, private equity, and legal experience, his primary responsibilities are to lead the strategic direction and operations of the real estate platform at NexPoint. McGraner has led the acquisition and financing of approximately $18.4 billion of real estate investments.

Brian Mitts

Chief Financial Officer

Brian Mitts is a member of the investment committee for the Sponsor and serves in numerous roles across the NexPoint platform. Currently, Mitts leads NexPoint’s financial reporting and accounting teams and is integral in financing and capital allocation decisions. Mitts was also a co-founder of NREA, as well as NXRT and NexPoint Advisors, L.P., the parent of NREA. He has worked for NREA or one of its affiliates since 2007.

D.C. Sauter

General Counsel

D.C. Sauter is General Counsel for Real Estate for NexPoint Advisors, L.P. Prior to joining NexPoint, he was a partner with Wick Phillips Gould & Martin, LLP, where his practice focused on all aspects of commercial real estate, including acquisitions, dispositions, entitlements, construction, financing, and leasing of industrial, office, retail, hotel, and multifamily assets. In addition to transactional matters, Sauter has significant experience in complex commercial disputes, foreclosures, and workouts.

An investment in NexPoint Life Sciences II DST is highly speculative, illiquid and involves substantial risk including the potential loss of your entire investment. The photos presented in this brochure are of the actual Properties that are part of the Offering.

There are substantial risks in any investment program. See “Risk Factors” on page 20 of the accompanying PPM for a discussion of the risks relevant to this Offering. Distributions are not guaranteed. Please review the entire PPM prior to investing. Reference is made to the PPM for a statement of risks and terms of the Offering. The information set forth herein is qualified in its entirety by the PPM. All prospective Purchasers must read the PPM and no person may invest without acknowledging receipt and complete review of the PPM.

An investment in an Interest is highly speculative and involves substantial risks including, but not limited to:

- this is a “best-efforts” offering with no minimum raise or minimum escrow requirements;

- the lack of liquidity and/or public market for the Interests;

- the holding of a beneficial interest in the Parent Trust with no voting rights with respect to the management or operations of the Trusts or in connection with the sale of the Properties;

- risks associated with owning, financing, operating and leasing pharmaceutical manufacturing facilities, and real estate generally, in Pennsylvania, and more specifically the Philadelphia-Reading-Camden Metro Statistical Area (the “Philadelphia MSA”);

- The Properties are located in a “Hurricane Susceptible Region,” which increases the risk of damage to the Properties;

- the Tenant is engaged in the business of pharmaceutical manufacturing which is a highly competitive business characterized by rapidly evolving technology and thus the Tenant’s failure to achieve commercial success will materially and adversely affect the Master Tenants’ and the Trusts’ operations;

- risks associated with the impact of pandemics, including the COVID-19 pandemic, on the Properties and the economics of the communities in which the Properties exist;

- under the Tenant Leases, the Tenant is allowed to make certain permitted alterations to the Properties which could adversely affect the Master Tenants’ ability to re-tenant the Properties to a new tenant;

- the Properties are highly specific to the Tenant’s pharmaceutical manufacturing operations, which may adversely affect the Master Tenants’ ability to re-tenant the Properties;

- the Tenant has a limited Repurchase Right with respect to the Properties only exercisable on each of the Repurchase Dates, thus limiting the Managers’ control over timing the sale of the applicable Property;

- the Trusts depend on the Master Tenants for revenue, and the Master Tenants depend on the Tenant for revenue and thus any default by the Master Tenants or the Tenant will adversely affect the Trusts’ operations;

- performance of the Master Tenants under their respective Master Leases, including the potential for the Master Tenants to defer a portion of rent payable under such Master Leases;

- reliance on the Master Tenants and the Property Manager engaged by the Master Tenants, to manage each of the Properties;

- risks associated with the Sponsor funding the Demand Notes that capitalize each of the Master Tenants;

- risks relating to the terms of the financing for the Properties, including the use of leverage;

- the existence of various conflicts of interest among the Sponsor, the Trusts, the Master Tenants, the Asset Manager, the Property Manager, and their affiliates;

- material tax risks, including treatment of the Interests for purposes of Code Section 1031, treatment of the Frontida Sale-Leaseback for federal income tax purposes, and the use of exchange funds to pay acquisition costs, which may result in taxable boot;

- the lack of a public market for the Interests;

- the Interests not being registered with the Securities and Exchange Commission (the “SEC”) or any state securities commissions;

- risks relating to the costs of compliance with laws, rules and regulations applicable to the Properties;

- lack of diversity of investment;

- risks related to competition from properties similar to and near the Properties, and

- the possibility of environmental risks related to the Properties

NexPoint Securities, Inc., an entity under common control with the Sponsor, serves as the Managing Broker-Dealer of the Offering.

The Managing Broker-Dealer was formed in November 2013 and is registered as a broker-dealer with the SEC and is a member of FINRA/SIPC.

PLEASE CONTACT YOUR ADVISOR WITH ANY QUESTIONS ABOUT THIS OFFERING.